Finance

What Is A FICO Score Of 9

Published: March 6, 2024

Learn about the FICO Score 9 and its impact on your finances. Understand how this credit scoring model can affect your borrowing options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the FICO Score 9: A Modern Approach to Credit Scoring

- Decoding the Foundation of FICO Score 9

- Evolution of Credit Scoring: Contrasting FICO Score 9 with Its Predecessors

- Empowering Lenders and Borrowers: Unveiling the Advantages of FICO Score 9

- A Paradigm Shift in Credit Assessment: Navigating the Implications of FICO Score 9

- Navigating the Future of Credit Scoring with FICO Score 9

Introduction

Understanding the FICO Score 9: A Modern Approach to Credit Scoring

When it comes to assessing an individual’s creditworthiness, the FICO score is a crucial factor that lenders consider. Developed by the Fair Isaac Corporation, the FICO score has undergone several iterations, with each version refining the methodology for evaluating credit risk. Among these versions, the FICO Score 9 stands out as a significant advancement in credit scoring.

As the financial landscape evolves, so too must the methods used to evaluate creditworthiness. The FICO Score 9 represents a modern approach to credit scoring, incorporating new elements that provide a more comprehensive and accurate assessment of an individual’s credit risk. Understanding the key features and implications of the FICO Score 9 is essential for both borrowers and lenders, as it directly impacts lending decisions and financial opportunities.

In this article, we will delve into the intricacies of the FICO Score 9, exploring its key components, differences from previous versions, and the potential benefits it offers to both lenders and borrowers. By gaining insight into the FICO Score 9, individuals can make informed financial decisions, while lenders can effectively evaluate credit risk in a rapidly changing economic environment.

What Is a FICO Score 9?

Decoding the Foundation of FICO Score 9

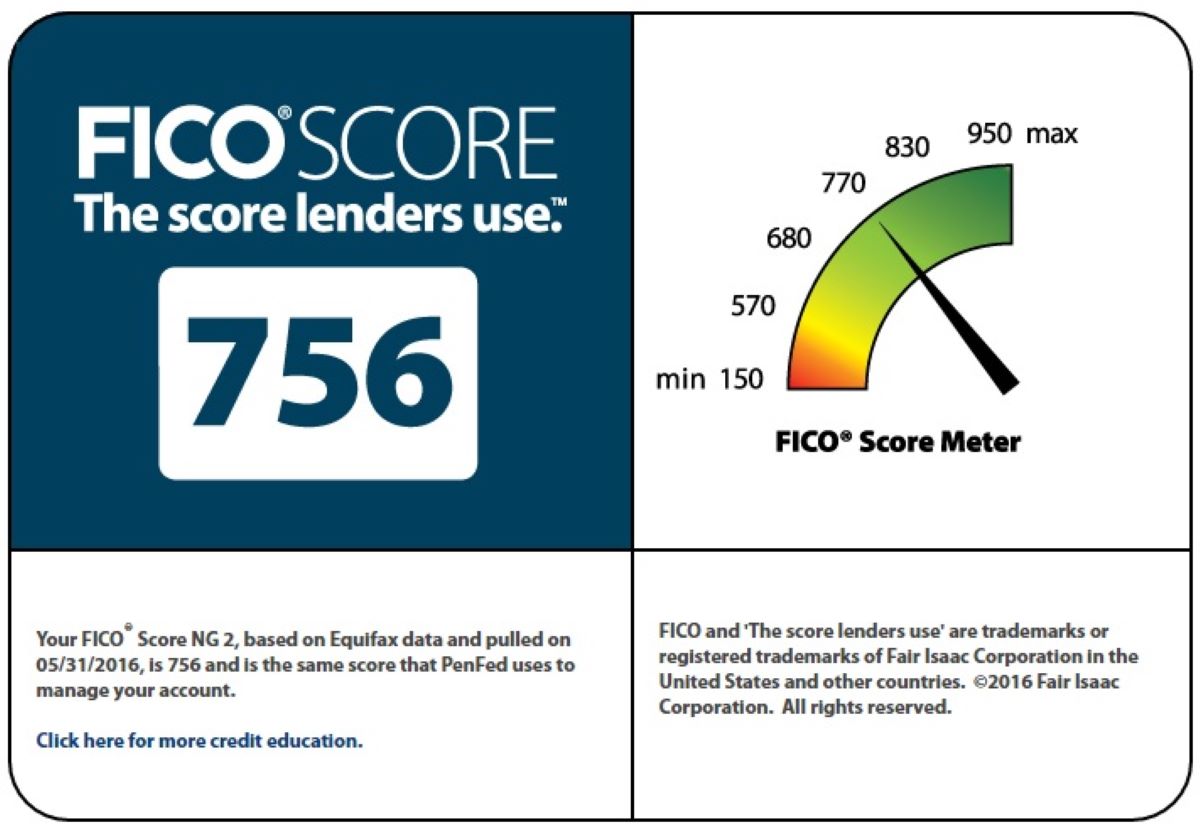

The FICO Score 9 is a credit scoring model developed by the Fair Isaac Corporation, designed to assess an individual’s credit risk and determine their likelihood of repaying debt. This scoring model is utilized by lenders to evaluate the creditworthiness of potential borrowers, influencing their decisions regarding loan approvals, interest rates, and credit limits.

Unlike its predecessors, the FICO Score 9 incorporates a more refined approach to evaluating credit risk, taking into account a broader spectrum of data to generate a comprehensive credit assessment. One of the distinguishing features of the FICO Score 9 is its treatment of medical collections and the inclusion of trended data, which provides a more nuanced understanding of an individual’s credit behavior over time.

Furthermore, the FICO Score 9 places a greater emphasis on the impact of collection accounts on credit scores, distinguishing between medical and non-medical collections. This distinction acknowledges the unique nature of medical debt and aims to mitigate the disproportionate impact it may have on an individual’s credit profile.

By incorporating these refinements, the FICO Score 9 aims to provide a more accurate representation of an individual’s credit risk, offering a fairer assessment that aligns with the evolving financial landscape. The utilization of trended data enables lenders to gain deeper insights into an individual’s credit behavior, empowering them to make more informed lending decisions.

In essence, the FICO Score 9 serves as a pivotal tool in the realm of credit assessment, leveraging advanced analytics to provide a holistic view of an individual’s creditworthiness. Its innovative approach to credit scoring reflects the ongoing commitment to enhancing the accuracy and fairness of credit evaluations, ultimately benefiting both lenders and borrowers in the financial ecosystem.

Key Differences Between FICO Score 9 and Previous Versions

Evolution of Credit Scoring: Contrasting FICO Score 9 with Its Predecessors

The FICO Score 9 introduces several pivotal changes that distinguish it from its predecessors, marking a significant evolution in credit scoring methodology. Understanding these key differences is essential for comprehending the advancements brought forth by the FICO Score 9 and its impact on credit assessment.

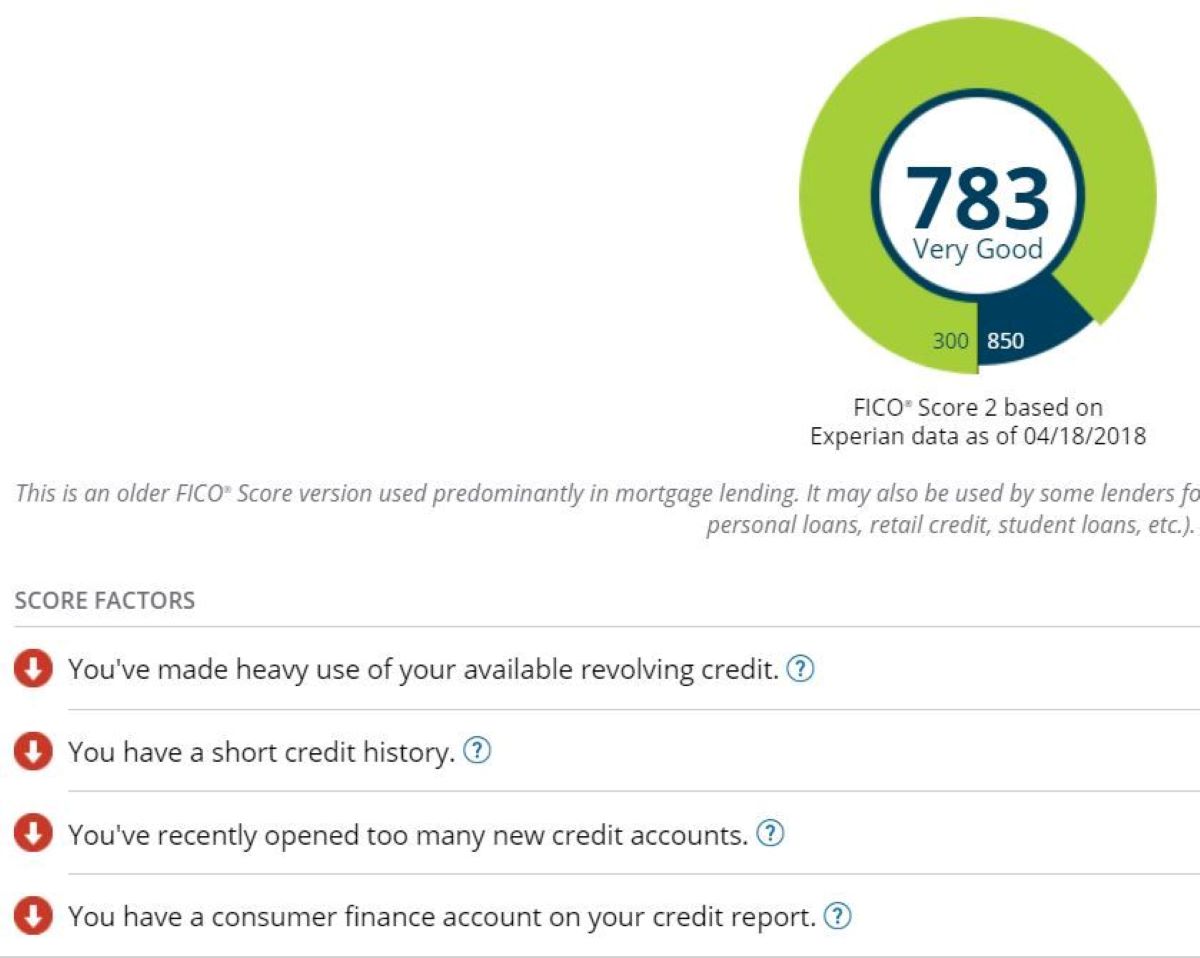

- Inclusion of Trended Data: Unlike previous versions, the FICO Score 9 incorporates trended data, offering a more comprehensive view of an individual’s credit behavior over time. This inclusion enables lenders to assess credit patterns and payment trends, providing a deeper understanding of an individual’s financial habits.

- Treatment of Medical Collections: One notable departure from earlier versions is the refined treatment of medical collections. The FICO Score 9 distinguishes medical collections from non-medical collections, recognizing the distinct nature of medical debt and mitigating its impact on credit scores, thereby promoting a fairer assessment of credit risk.

- Weighting of Paid Collections: FICO Score 9 assigns less weight to paid collections, acknowledging that individuals who have settled their outstanding collection accounts demonstrate a lower credit risk. This adjustment reflects a more lenient approach towards individuals who have taken proactive steps to address their past credit issues.

- Enhanced Predictive Capabilities: With its refined algorithms, the FICO Score 9 boasts enhanced predictive capabilities, enabling more accurate credit risk assessment. This advancement aligns with the ongoing pursuit of precision and fairness in credit scoring, benefiting both lenders and borrowers.

These fundamental differences between the FICO Score 9 and its predecessors underscore the progressive nature of credit scoring, emphasizing the importance of adapting scoring models to align with evolving financial dynamics. By embracing these advancements, lenders can make more informed lending decisions, while borrowers can benefit from a more equitable evaluation of their creditworthiness.

Benefits of FICO Score 9

Empowering Lenders and Borrowers: Unveiling the Advantages of FICO Score 9

The implementation of the FICO Score 9 heralds a host of benefits for both lenders and borrowers, ushering in a new era of credit assessment that prioritizes fairness, accuracy, and predictive capability. Understanding these advantages is crucial for comprehending the transformative impact of the FICO Score 9 on the lending landscape.

- Improved Evaluation of Medical Collections: By distinguishing medical collections from non-medical collections, the FICO Score 9 offers a more nuanced assessment of credit risk, mitigating the disproportionate impact of medical debt on credit scores. This refinement fosters a fairer evaluation of individuals with medical collections, providing them with enhanced opportunities for obtaining credit.

- Recognition of Paid Collections: The FICO Score 9 assigns less weight to paid collections, acknowledging the proactive efforts of individuals in addressing their past credit issues. This recognition incentivizes responsible credit behavior and offers a pathway for individuals to rebuild their credit standing, fostering financial inclusivity and empowerment.

- Utilization of Trended Data: Incorporating trended data enables lenders to gain deeper insights into an individual’s credit behavior over time, facilitating a more comprehensive assessment of credit risk. This enhanced visibility into payment patterns and credit utilization empowers lenders to make more informed lending decisions, while providing borrowers with opportunities for fairer credit evaluations.

- Enhanced Predictive Capabilities: The refined algorithms of the FICO Score 9 contribute to enhanced predictive capabilities, enabling lenders to more accurately assess credit risk. This advancement not only benefits lenders by reducing the likelihood of defaults and delinquencies but also provides borrowers with the potential for improved access to credit and favorable terms.

These benefits collectively underscore the transformative impact of the FICO Score 9, signaling a paradigm shift towards a more equitable and insightful approach to credit assessment. By fostering fairness, inclusivity, and predictive accuracy, the FICO Score 9 empowers both lenders and borrowers, laying the groundwork for a more dynamic and responsive lending ecosystem.

How FICO Score 9 Impacts Lenders and Borrowers

A Paradigm Shift in Credit Assessment: Navigating the Implications of FICO Score 9

The adoption of the FICO Score 9 has far-reaching implications for both lenders and borrowers, reshaping the dynamics of credit assessment and lending decisions. Understanding how this modern scoring model impacts stakeholders is essential for navigating the evolving landscape of credit evaluation and financial opportunities.

Impact on Lenders:

For lenders, the implementation of the FICO Score 9 represents a significant advancement in credit risk assessment. The inclusion of trended data equips lenders with a more comprehensive understanding of an individual’s credit behavior, enabling them to make more informed lending decisions. By leveraging enhanced predictive capabilities, lenders can mitigate the risk of defaults and delinquencies, leading to a more prudent allocation of credit and reduced exposure to potential losses. Furthermore, the refined treatment of medical collections and paid accounts fosters a fairer and more inclusive approach to credit evaluation, aligning with the principles of responsible lending and financial inclusivity.

Impact on Borrowers:

For borrowers, the advent of the FICO Score 9 offers a pathway to fairer and more transparent credit assessment. The distinction between medical and non-medical collections, coupled with the reduced weight assigned to paid collections, provides individuals with opportunities to improve their credit standing and access credit on more favorable terms. Moreover, the utilization of trended data offers borrowers the chance to showcase their evolving credit behavior, potentially offsetting past setbacks and demonstrating responsible financial management. As a result, borrowers may experience increased access to credit, lower interest rates, and a more equitable evaluation of their creditworthiness, empowering them to pursue their financial goals with greater confidence.

The impact of the FICO Score 9 reverberates throughout the lending ecosystem, fostering a climate of fairness, accuracy, and mutual benefit for both lenders and borrowers. By recalibrating the dynamics of credit assessment, this modern scoring model paves the way for a more inclusive and responsive financial landscape, where credit opportunities are aligned with individual credit behaviors and risk profiles.

Conclusion

Navigating the Future of Credit Scoring with FICO Score 9

The emergence of the FICO Score 9 marks a pivotal juncture in the evolution of credit scoring, heralding a new era of precision, equity, and insight in credit assessment. As this modern scoring model permeates the lending landscape, its impact reverberates across the financial ecosystem, shaping the dynamics of lending decisions and empowering individuals to pursue their financial aspirations with confidence.

With its emphasis on trended data, refined treatment of collections, and enhanced predictive capabilities, the FICO Score 9 embodies a paradigm shift towards a more holistic and equitable approach to credit evaluation. By providing lenders with deeper insights into credit behavior and risk profiles, this scoring model facilitates more informed lending decisions, reducing the likelihood of defaults and delinquencies while fostering financial inclusivity.

For borrowers, the FICO Score 9 offers a beacon of opportunity, presenting a fairer and more transparent pathway to credit access. The nuanced treatment of medical collections, recognition of paid accounts, and utilization of trended data provide individuals with the potential to showcase their evolving credit behavior and mitigate the impact of past credit challenges. This, in turn, can lead to improved access to credit, lower interest rates, and a more accurate reflection of their creditworthiness.

As the financial landscape continues to evolve, the FICO Score 9 stands as a testament to the ongoing commitment to refining credit assessment methodologies, aligning them with the dynamic realities of individual credit behaviors and economic shifts. By embracing the advancements embodied in the FICO Score 9, stakeholders in the lending ecosystem can navigate a landscape characterized by fairness, accuracy, and mutual benefit.

In essence, the FICO Score 9 represents a catalyst for positive change, fostering a climate where credit opportunities are aligned with individual credit behaviors and risk profiles. Its impact transcends mere numbers, embodying the principles of inclusivity, fairness, and empowerment in the realm of credit assessment. As we navigate the future of credit scoring, the FICO Score 9 stands as a beacon of progress, illuminating a path towards a more equitable and insightful financial landscape.