Finance

Where Is Prepaid Rent On The Balance Sheet

Modified: March 2, 2024

Learn about prepaid rent and its placement on the balance sheet in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to maintaining accurate financial records, businesses must account for various expenses and assets on their balance sheets. One of these elements is prepaid rent. Prepaid rent refers to the payment made in advance for the use of a property or space over a specific period of time. While it may seem straightforward, understanding where prepaid rent fits on the balance sheet and its implications is crucial for financial reporting and analysis.

In this article, we will delve into the definition and explanation of prepaid rent, explore how it is initially recorded, and discuss its classification and presentation on the balance sheet. Additionally, we will highlight the impact of prepaid rent on the financial statements and provide examples to illustrate its practical application.

By gaining a comprehensive understanding of prepaid rent, businesses can accurately track their financial obligations, make informed decisions, and adhere to accounting standards. So, let’s dive into the world of prepaid rent and unravel its significance on the balance sheet.

Definition and Explanation of Prepaid Rent

Prepaid rent refers to a payment made in advance by a business for the use of a property or space over a specific period of time. It is a form of prepaid expense, where the expense is paid for in advance rather than at the time of actual usage. The prepaid rent amount is typically paid to a landlord or property owner to secure the right to occupy and use a physical space.

Businesses often opt for prepaid rent arrangements to secure favorable lease terms or to ensure uninterrupted access to a property. By making upfront payments, they can solidify their commitments and establish a stable operating environment. Prepaid rent is commonly seen in industries such as retail, hospitality, and commercial real estate.

It is important to note that prepaid rent represents a future expense, as the business will utilize the rented space over a specified time period. As the rental period progresses, the amount of prepaid rent decreases, and the rent expense is recognized on the income statement.

Now, let’s explore how prepaid rent is initially recorded and its implications on the balance sheet.

Initial Recording of Prepaid Rent

When a business makes a payment for prepaid rent, it needs to record the transaction properly in its accounting system. The initial recording of prepaid rent involves a double-entry bookkeeping method, which ensures that the financial records are accurate and balanced.

Let’s consider an example: ABC Company pays $12,000 in January for six months of rent in advance for their office space. To record this transaction, the following journal entry is made:

- Debit Prepaid Rent: $12,000

- Credit Cash or Bank: $12,000

In this journal entry, the debit to the Prepaid Rent account increases the asset side of the balance sheet, reflecting the amount paid in advance for future rent. On the other hand, the credit to the Cash or Bank account reduces the asset side of the balance sheet because cash has been expended to make the payment.

It is important to note that the above example assumes a simple prepaid rent scenario. In some cases, businesses may negotiate complex lease agreements with additional clauses such as prepaid rent discounts, security deposits, or leasehold improvements. These factors can affect the initial recording of prepaid rent and may require adjustments or separate accounting entries.

Now that we have understood how prepaid rent is initially recorded, let’s explore its classification on the balance sheet.

Classification of Prepaid Rent on the Balance Sheet

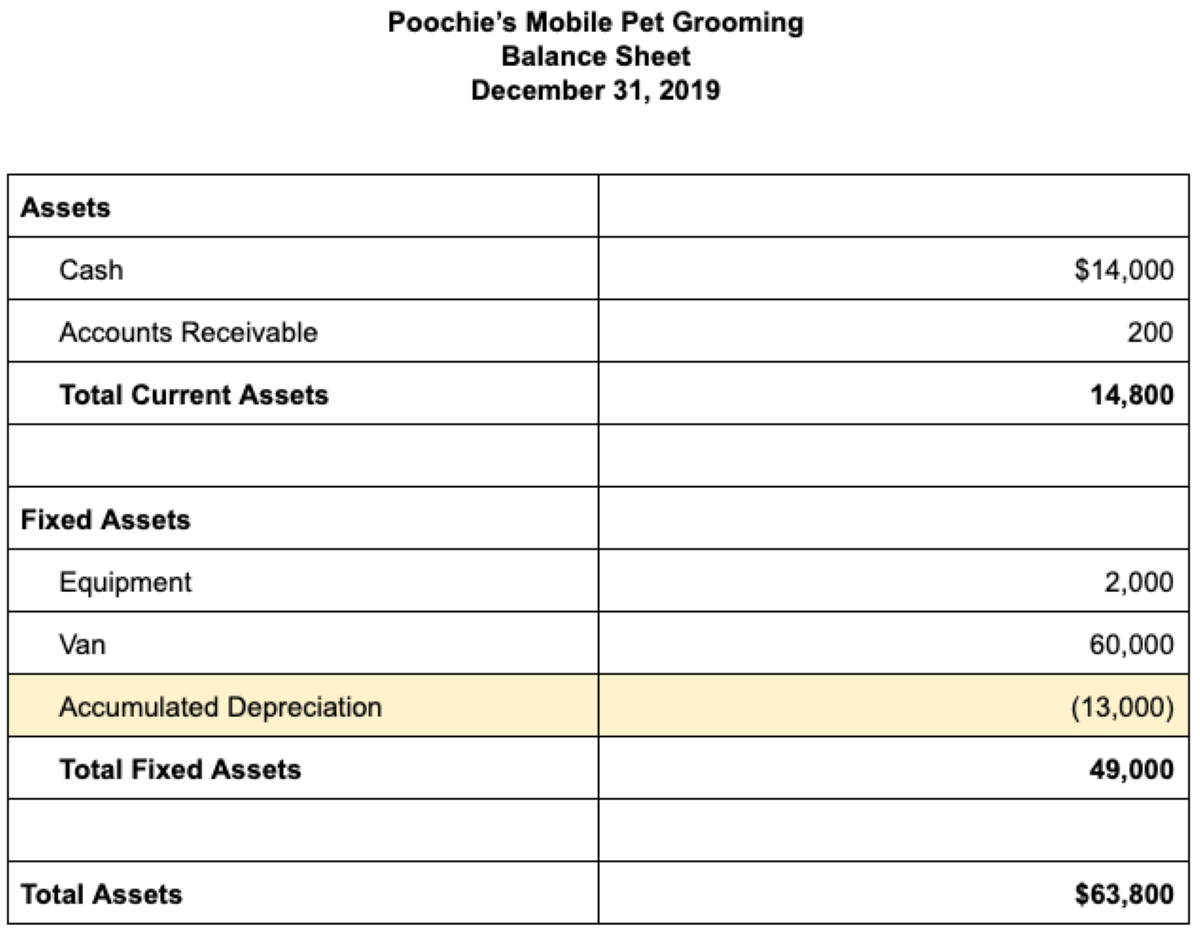

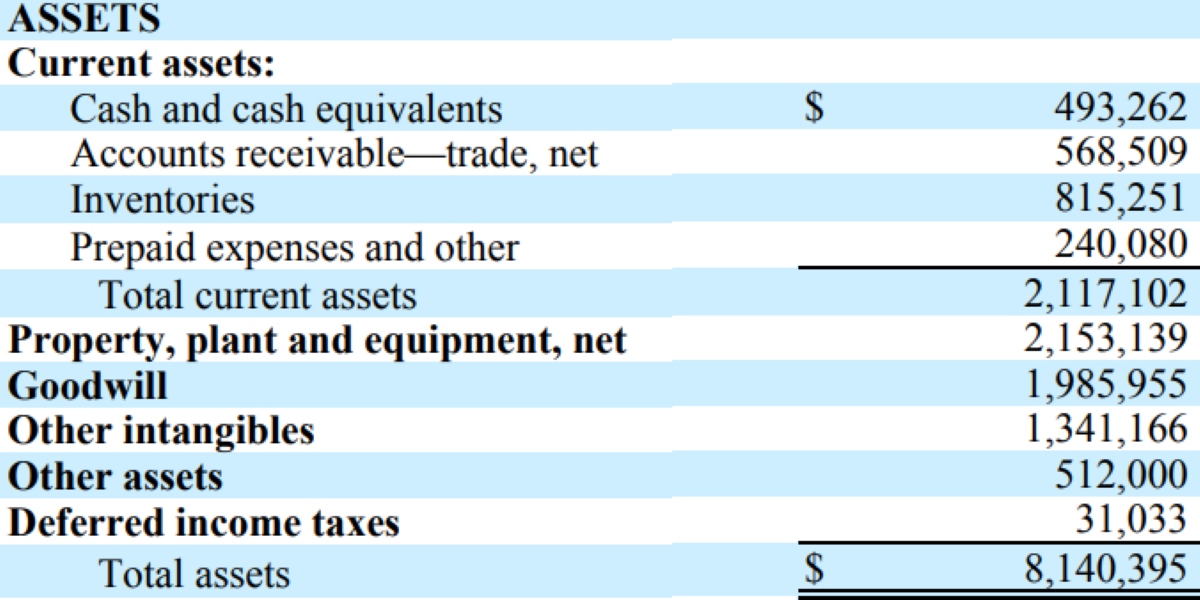

On the balance sheet, prepaid rent is classified as a current asset. A current asset is an asset that is expected to be consumed or converted into cash within one year or the normal operating cycle of the business, whichever is longer.

Prepaid rent is classified as a current asset because it represents the portion of rent paid in advance for a period of time that falls within the next 12 months. As the time passes and the prepaid rent is utilized, it is gradually recognized as an expense on the income statement.

Within the current asset section of the balance sheet, prepaid rent is typically listed under the category of “Prepaid Expenses” or “Other Current Assets.” This placement reflects its nature as an asset that will be consumed or utilized in the near term. It is important for businesses to accurately track and report the amount of prepaid rent on the balance sheet to provide transparency and ensure compliance with accounting standards.

Furthermore, when preparing financial statements, businesses should segregate prepaid rent from other types of prepaid expenses, such as prepaid insurance or prepaid advertising. This allows stakeholders to have a clear understanding of the specific assets that are prepaid and their associated values.

Now that we have discussed the classification of prepaid rent on the balance sheet, let’s move on to understanding its presentation.

Presentation of Prepaid Rent on the Balance Sheet

Prepaid rent is presented on the balance sheet as a current asset. It is listed under the “Prepaid Expenses” or “Other Current Assets” section, depending on the specific categorization used by the business.

Within the current asset section, prepaid rent is typically disclosed as a separate line item, providing transparency and clarity regarding the amount of rent paid in advance.

For example, let’s assume that ABC Company has a prepaid rent amount of $12,000. The presentation of prepaid rent on their balance sheet would look like this:

- Current Assets:

- Cash or Bank: $XX,XXX

- Accounts Receivable: $XX,XXX

- Inventory: $XX,XXX

- Prepaid Expenses:

- Prepaid Rent: $12,000

- Other Prepaid Expenses: $XX,XXX

- …

- …

This presentation allows stakeholders to quickly identify the amount of prepaid rent on the balance sheet, providing valuable information about the business’s financial commitments and obligations.

It is worth noting that as the prepaid rent is consumed over time, the balance in the prepaid rent account will decrease. To accurately reflect this decrease, businesses should make adjusting entries at the end of each reporting period to recognize the portion of prepaid rent expense that corresponds to the time expired.

Now that we understand how prepaid rent is presented on the balance sheet, let’s explore the impact this has on the financial statements.

Impact of Prepaid Rent on Financial Statements

Prepaid rent has an impact on the financial statements of a business, particularly the balance sheet and the income statement.

On the balance sheet, prepaid rent is classified as a current asset and is presented under the “Prepaid Expenses” or “Other Current Assets” section. It represents the amount of rent paid in advance for a future period of time. As the prepaid rent is utilized, the balance decreases, reflecting the portion of rent that has been consumed.

On the income statement, prepaid rent is gradually recognized as an expense over the period it corresponds to. Each month, an adjusting journal entry is made to allocate a portion of the prepaid rent to the rent expense for that period.

The impact of prepaid rent on the financial statements can be observed as follows:

- Balance Sheet: Prepaid rent is reported as a current asset. As time passes and the prepaid rent is utilized, the balance decreases, reflecting the portion of rent that has been consumed.

- Income Statement: The portion of prepaid rent that corresponds to the time period is recognized as an expense on the income statement. This expense is recorded under the rent expense category and affects the calculation of the net income for the period.

It is important to note that the impact of prepaid rent on the financial statements extends beyond the balance sheet and income statement. It also affects other financial ratios and metrics, such as the current ratio and the operating profit margin. Therefore, accurate tracking and proper recognition of prepaid rent is essential for financial reporting and analysis.

Now that we understand the impact of prepaid rent on the financial statements, let’s explore some examples to further illustrate its practical application.

Examples of Prepaid Rent on the Balance Sheet

Let’s look at a couple of examples to understand how prepaid rent is recorded and presented on the balance sheet.

Example 1:

ABC Company enters into a lease agreement for office space and pays $9,000 in advance for six months of rent. To record this transaction, the following journal entry is made:

- Debit Prepaid Rent: $9,000

- Credit Cash or Bank: $9,000

On the balance sheet, the presentation of prepaid rent for ABC Company would look like this:

- Current Assets:

- Cash or Bank: $XX,XXX

- Accounts Receivable: $XX,XXX

- Inventory: $XX,XXX

- Prepaid Expenses:

- Prepaid Rent: $9,000

- Other Prepaid Expenses: $XX,XXX

- …

- …

As time passes and each month elapses, ABC Company would make an adjusting entry to recognize the portion of prepaid rent that corresponds to the expired month as an expense on the income statement.

Example 2:

XYZ Corporation signs a lease agreement for its manufacturing facility and pays $36,000 in advance for a year of rent. To record this transaction, the following journal entry is made:

- Debit Prepaid Rent: $36,000

- Credit Cash or Bank: $36,000

On the balance sheet, the presentation of prepaid rent for XYZ Corporation would look like this:

- Current Assets:

- Cash or Bank: $XX,XXX

- Accounts Receivable: $XX,XXX

- Inventory: $XX,XXX

- Prepaid Expenses:

- Prepaid Rent: $36,000

- Other Prepaid Expenses: $XX,XXX

- …

- …

As each month passes and the prepaid rent is utilized, XYZ Corporation would adjust the prepaid rent balance by recording a portion as an expense on the income statement.

These examples illustrate how prepaid rent is recorded and presented on the balance sheet. Proper accounting and tracking of prepaid rent allow businesses to accurately reflect their financial obligations and provide stakeholders with transparent financial information.

Now, let’s summarize what we have learned so far.

Conclusion

Prepaid rent plays a crucial role in the financial records of businesses. It represents the advance payment made for occupying and utilizing a property or space over a specific period of time. Understanding where prepaid rent fits on the balance sheet and its implications is essential for accurate financial reporting and analysis.

In this article, we have explored the definition and explanation of prepaid rent, how it is initially recorded, its classification on the balance sheet, and its presentation. We have also discussed the impact of prepaid rent on the financial statements, such as the balance sheet and income statement.

Prepaid rent is classified as a current asset and is presented under the “Prepaid Expenses” or “Other Current Assets” section on the balance sheet. As time passes, the prepaid rent amount decreases as it is utilized, and the corresponding portion is recognized as an expense on the income statement.

Accurate tracking and proper recognition of prepaid rent are crucial for businesses to maintain transparent financial records and comply with accounting standards. Investors, lenders, and other stakeholders rely on accurate financial information to make informed decisions and assess a company’s financial health.

By understanding the key concepts and principles surrounding prepaid rent, businesses can effectively manage their financial resources, track their liabilities, and make strategic decisions related to rent payments and leases.

In conclusion, prepaid rent is a significant element in the world of finance and accounting. By properly accounting for prepaid rent and presenting it on the balance sheet, businesses can maintain transparent and accurate financial records, providing a solid foundation for financial stability and growth.