Finance

What Is A Balance Sheet In Quickbooks

Modified: December 30, 2023

Learn what a balance sheet is in QuickBooks and how it can help you manage your finances. Discover the importance of this financial statement for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of QuickBooks and the importance of balance sheets. In the realm of finance, balance sheets are a vital tool for assessing the financial health and stability of a business. QuickBooks, a popular accounting software, provides users with a comprehensive platform for managing their financial transactions and generating essential financial reports, including the balance sheet.

In this article, we will delve into the concept of balance sheets within the QuickBooks ecosystem. We will explore what exactly a balance sheet is, its purpose, and how it can be utilized effectively in QuickBooks to gain valuable insights into a company’s financial position.

Whether you are a small business owner hoping to gain a better understanding of your financial standing or an accounting professional looking to optimize your use of QuickBooks, this article will serve as your guide to mastering the intricacies of balance sheets within the QuickBooks software.

So, let’s begin our journey by unraveling the definition of a balance sheet and its significance in the world of QuickBooks.

Definition of a Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the company’s assets, liabilities, and equity. The main purpose of a balance sheet is to show what a company owns (assets), what it owes (liabilities), and the residual value for the owners or shareholders (equity).

Balance sheets adhere to the fundamental accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet’s three main components are always in balance. Simply put, a balance sheet shows how a company’s resources (assets) are financed by debt (liabilities) and the owner’s investment (equity).

Assets represent the resources owned or controlled by a company that can generate economic benefits. Common examples include cash, accounts receivable, inventory, property, and equipment. Liabilities, on the other hand, are the obligations or debts that a company owes to external parties, such as loans, accounts payable, or accrued expenses. Equity represents the residual interest in the assets of the company after deducting its liabilities. It includes the owner’s investment and any retained earnings.

By accurately preparing and analyzing a balance sheet, business owners and stakeholders can assess the financial health, stability, and liquidity of a company. It enables them to evaluate the company’s ability to meet its financial obligations, make informed decisions on investments and financing, and gauge the overall effectiveness of its operations.

In the context of QuickBooks, the software streamlines the process of creating and maintaining balance sheets. It automatically aggregates the relevant financial data entered into the system and generates balance sheets with ease. The user-friendly interface allows users to view and analyze their balance sheets in real-time, providing valuable insights into their financial standing for strategic decision-making.

Purpose of a Balance Sheet in QuickBooks

The balance sheet serves a crucial purpose in QuickBooks, as it provides a comprehensive overview of a company’s financial position. Let’s explore the main objectives and advantages of using a balance sheet in QuickBooks:

- Assessing Financial Health: One of the primary purposes of a balance sheet in QuickBooks is to assess the financial health of a company. It presents a snapshot of the company’s assets, liabilities, and equity, allowing users to gauge its solvency, liquidity, and overall financial stability. By analyzing the balance sheet, business owners and stakeholders can determine if a company has enough resources to cover its financial obligations.

- Reviewing Financial Performance: QuickBooks balance sheets enable users to review the performance of a company over a specific period. By comparing balance sheets from different periods, users can identify trends, track changes in assets and liabilities, and evaluate the effectiveness of financial management strategies. This information is invaluable for making informed decisions, identifying areas of improvement, and setting realistic goals.

- Facilitating Financial Planning: QuickBooks balance sheets serve as a foundation for financial planning and forecasting. By understanding the current financial position, business owners can anticipate future cash flows, identify potential funding gaps, and proactively plan for expansion, investment, or debt management. Financial planning supported by accurate balance sheets helps businesses stay on track and make prudent financial decisions.

- Attracting Investors and Lenders: Balance sheets generated in QuickBooks provide a clear and concise overview of a company’s financial health. This information is crucial when seeking funding from investors or lenders. Prospective investors and lenders will often review a business’s balance sheet to assess its financial viability, evaluate its risk profile, and determine the capacity for repayment. A well-prepared balance sheet demonstrates transparency and instills confidence in potential stakeholders.

- Complying with Legal and Regulatory Requirements: QuickBooks balance sheets help businesses comply with legal and regulatory requirements. They provide essential financial information for tax reporting, financial audits, and potential investigations. By maintaining accurate and up-to-date balance sheets in QuickBooks, businesses can demonstrate compliance and avoid any legal or regulatory issues related to financial reporting.

In summary, the balance sheet in QuickBooks serves as a powerful tool for financial analysis, planning, and decision-making. It enables businesses to evaluate their financial performance, attract potential investors or lenders, and ensure compliance with legal and regulatory requirements. By harnessing the capabilities of QuickBooks, users can efficiently generate and utilize balance sheets to gain valuable insights into their company’s financial standing.

Components of a Balance Sheet in QuickBooks

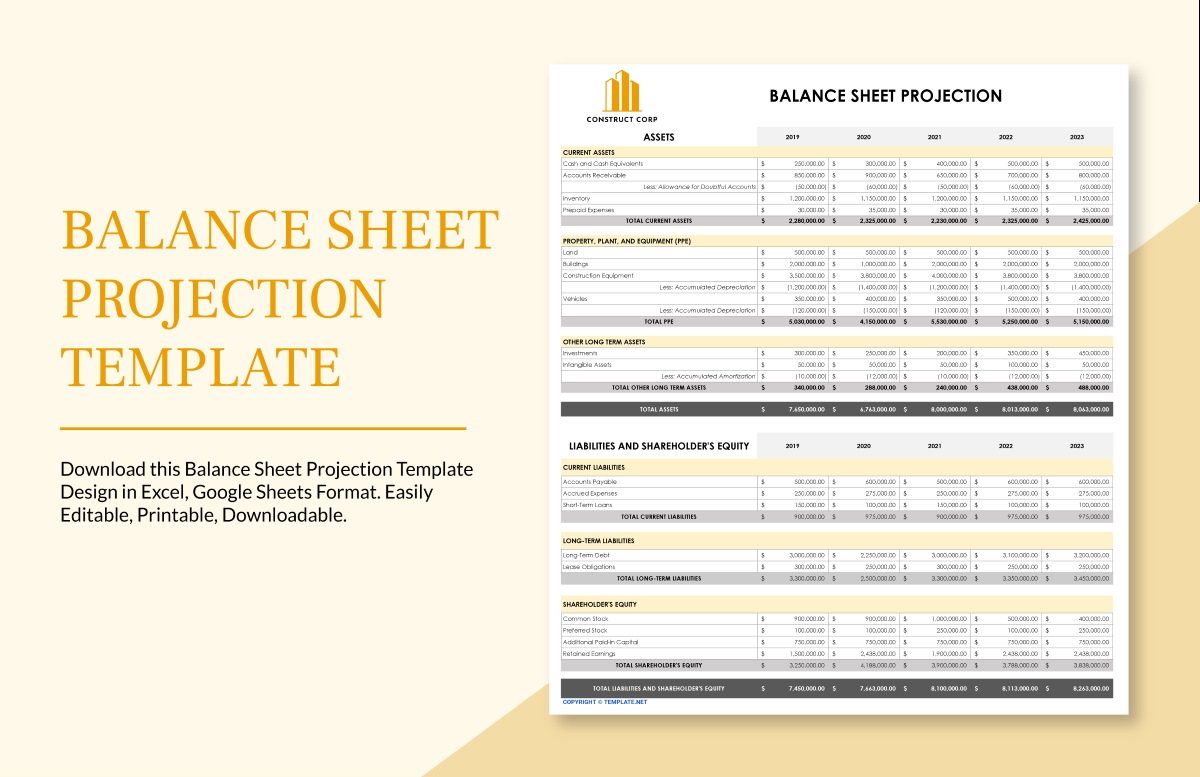

A balance sheet in QuickBooks consists of three main components: assets, liabilities, and equity. Let’s explore each component in detail:

- Assets: Assets represent the resources owned or controlled by a company that have economic value. QuickBooks classifies assets into current assets and long-term assets. Current assets include cash, accounts receivable, inventory, and short-term investments. Long-term assets include property, plant, and equipment, as well as long-term investments. Assets are vital to a company’s operations and are listed on the balance sheet in order of liquidity, with the most liquid assets appearing first.

- Liabilities: Liabilities are the obligations or debts that a company owes to external parties. Similar to assets, QuickBooks divides liabilities into current liabilities and long-term liabilities. Current liabilities encompass accounts payable, short-term loans, and accrued expenses. Long-term liabilities consist of long-term loans, bonds payable, and other non-current obligations. Liabilities are listed on the balance sheet in the order of their maturity, with the most immediate or short-term liabilities appearing first.

- Equity: Equity represents the residual interest in a company’s assets after deducting its liabilities. It reflects the ownership interest of the shareholders or owners in the company. In QuickBooks, equity is categorized into various accounts, such as owner’s equity, retained earnings, and contributed capital. Equity can increase through owner investments, retained earnings from profits, or additional capital injections. It can decrease through losses, dividends, or withdrawals. Equity is a critical component of the balance sheet as it represents the net worth of the company.

The balance sheet in QuickBooks follows the basic accounting equation: Assets = Liabilities + Equity. This equation ensures that the balance sheet remains balanced and provides an accurate representation of the company’s financial standing.

Each component of the balance sheet plays a vital role in assessing a company’s financial health and stability. Assets reflect the resources available to the company, liabilities represent its financial obligations, and equity signifies the ownership interest. By analyzing these components in QuickBooks, users can gain insights into a company’s financial position, make informed business decisions, and monitor the overall financial well-being of the organization.

Assets

In QuickBooks, assets are categorized into two main types: current assets and long-term assets. These assets represent the resources owned or controlled by a company that have economic value. Let’s explore each type in more detail:

- Current Assets: Current assets in QuickBooks include assets that are expected to be converted into cash or used up within one year. These assets are crucial for the day-to-day operations of the business. Common examples of current assets include:

- Cash: This includes physical cash, bank account balances, and cash equivalents such as money market funds.

- Accounts Receivable: These are amounts owed to the company by customers for goods or services provided on credit.

- Inventory: This represents the goods held by the company for sale or raw materials used in production.

- Prepaid Expenses: These are expenses paid in advance but not yet consumed, such as prepaid insurance or prepaid rent.

- Short-Term Investments: These are investments that can be easily converted into cash within a short period, such as marketable securities.

- Long-Term Assets: Long-term assets are resources that are not expected to be converted into cash within one year. These assets have a useful life of more than a year and are critical for the long-term success of the business. Examples of long-term assets in QuickBooks include:

- Property, Plant, and Equipment: This includes land, buildings, vehicles, machinery, and other tangible assets used in the operations of the business.

- Intangible Assets: These assets have no physical substance but have value, such as patents, copyrights, trademarks, and goodwill.

- Long-Term Investments: These are investments in other companies, bonds, or long-term deposits that are held for more than one year.

Assets play a crucial role in the financial health and liquidity of a company. They represent the resources that can generate economic benefits and contribute to the value and profitability of the business. QuickBooks provides a comprehensive platform to record and track the various assets of a company, making it easier to monitor their performance, depreciation, and overall impact on the financial health of the organization.

Liabilities

In QuickBooks, liabilities are financial obligations or debts that a company owes to external parties. These liabilities play a crucial role in assessing the company’s financial standing and determining its ability to meet its obligations. Let’s explore the different types of liabilities in QuickBooks:

- Current Liabilities: Current liabilities in QuickBooks are obligations that are expected to be settled within one year or the normal operating cycle of the business, whichever is longer. Examples of current liabilities include:

- Accounts Payable: This represents the amounts owed to suppliers or vendors for goods or services purchased on credit.

- Short-Term Loans: These are borrowings that are due within one year, such as lines of credit, short-term bank loans, or credit card debts.

- Accrued Expenses: These are expenses that have been incurred but not yet paid, such as salaries payable, interest payable, or taxes payable.

- Unearned Revenue: This represents payments received in advance from customers for goods or services that have not yet been provided.

- Long-Term Liabilities: Long-term liabilities in QuickBooks are obligations that are not expected to be settled within one year. These liabilities have a longer-term impact on the company’s financial health. Examples of long-term liabilities include:

- Long-Term Loans: These are borrowings with a repayment period exceeding one year, such as mortgages, equipment financing, or bonds payable.

- Deferred Revenue: This represents revenue received in advance for goods or services that will be provided over a longer period of time.

- Lease obligations: Obligations stemming from long-term lease agreements for property or equipment.

Liabilities represent the claims or debts that need to be fulfilled by the company. They indicate the company’s financial obligations to various stakeholders, including suppliers, lenders, employees, and government entities. QuickBooks provides a convenient way to track and manage liabilities, ensuring that the company remains accountable and able to meet its financial commitments.

Equity

In QuickBooks, equity represents the ownership interest in a company. It signifies the residual value of the company’s assets after deducting its liabilities. Equity is an important component of the balance sheet as it reflects the shareholders’ or owners’ claim on the company’s assets. Let’s delve into the different aspects of equity in QuickBooks:

- Owner’s Equity: Owner’s equity is the portion of equity that represents the total investment made by the owners in the company. It includes the initial capital contributions made by the owners and any additional investments made over time.

- Retained Earnings: Retained earnings are the accumulated profits or losses from the company’s operations that have not been distributed to the owners in the form of dividends. Retained earnings represent the portion of earnings that the company has retained and reinvested back into the business.

- Contributed Capital: Contributed capital represents the funds received from investors or shareholders in exchange for ownership shares in the company. It includes the proceeds from the issuance of common stock, preferred stock, or other forms of equity financing.

Equity is a significant indicator of the financial health and value of a company. It serves as a measure of the owners’ or shareholders’ stake in the business and represents the net worth of the company. Positive equity indicates that the company’s assets exceed its liabilities, while negative equity suggests that the liabilities exceed the assets.

QuickBooks provides a platform to track and manage the various equity accounts within the equity section of the balance sheet. It allows users to record owner investments, track retained earnings, and monitor equity changes over time. By maintaining accurate and up-to-date equity records in QuickBooks, business owners can assess the overall financial position of the company and understand the value attributable to the owners or shareholders.

Examples of Balance Sheet Accounts in QuickBooks

QuickBooks offers a comprehensive range of balance sheet accounts to help businesses organize and track their financial information. These accounts represent different aspects of a company’s assets, liabilities, and equity. Let’s explore some common examples of balance sheet accounts in QuickBooks:

- Cash: The cash account tracks the amount of money the company has in hand, including physical cash and bank account balances.

- Accounts Receivable: This account represents the amounts owed to the company by customers for goods or services provided on credit.

- Inventory: The inventory account reflects the value of the goods held by the company for sale or raw materials used in production.

- Accounts Payable: This account records the amounts owed by the company to suppliers or vendors for goods or services received on credit.

- Loans Payable: The loans payable account represents the outstanding balances and interest payable on loans or credit lines.

- Owner’s Equity: This account tracks the capital contributions made by the owners or shareholders to the company.

- Retained Earnings: The retained earnings account shows the accumulated profits or losses from the company’s operations that have not been distributed as dividends.

- Common Stock: Common stock account records the value of shares issued to the company’s owners or shareholders.

- Fixed Assets: The fixed assets account represents tangible assets, such as property, plant, and equipment, which are used in the company’s operations and have a long-term useful life.

- Long-Term Debt: This account reflects the long-term obligations or loans that are due beyond one year from the balance sheet date.

These examples are just a snapshot of the many balance sheet accounts available in QuickBooks. The software allows businesses to customize and create additional accounts based on their specific needs and industry requirements. By accurately categorizing and tracking these accounts, businesses can generate reports and gain insights into their financial position at any given time.

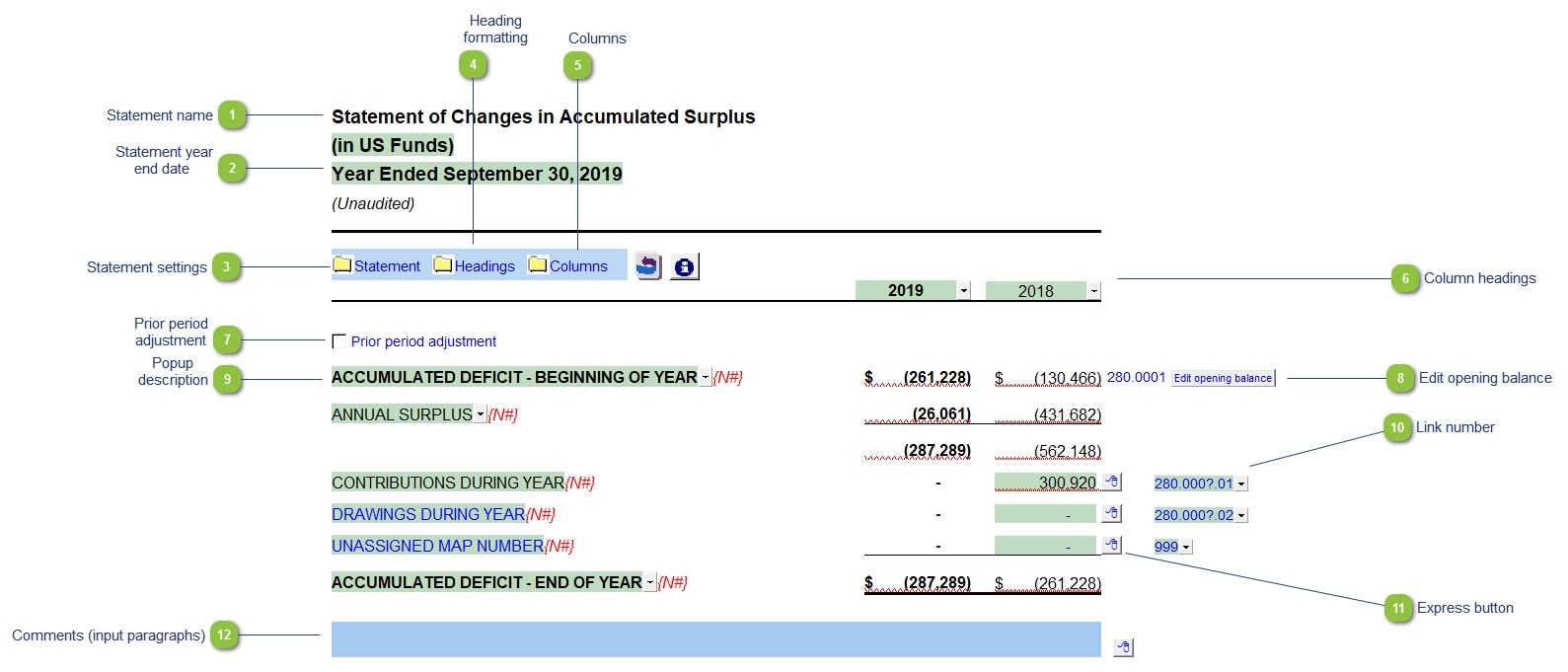

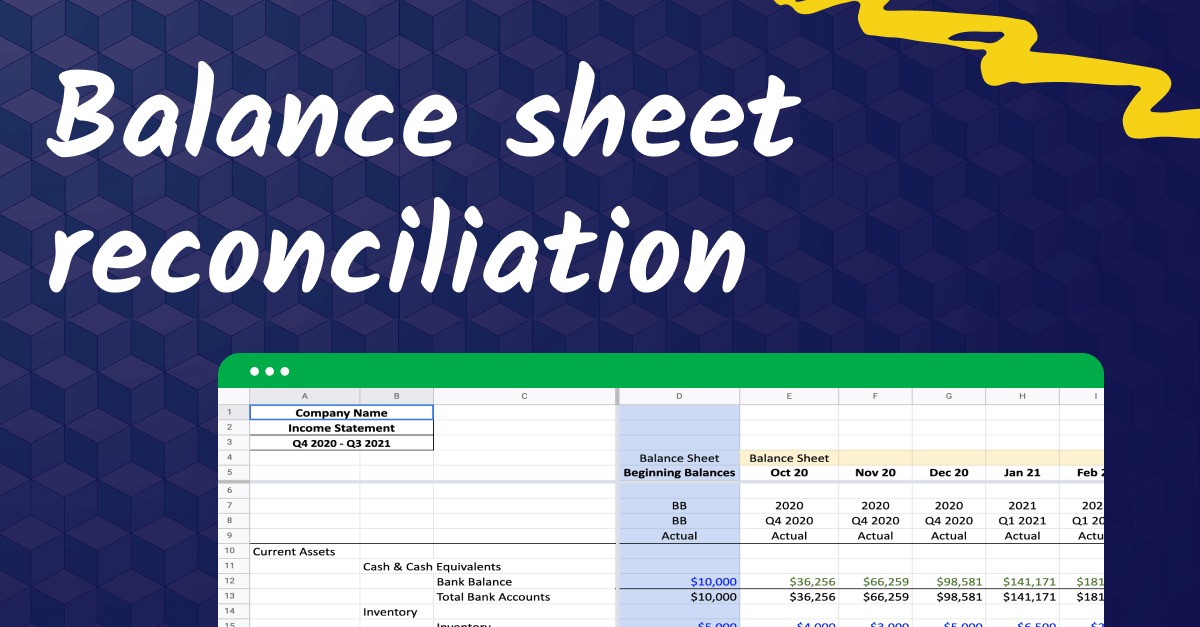

Creating a Balance Sheet in QuickBooks

Creating a balance sheet in QuickBooks is a straightforward process that allows businesses to generate accurate and up-to-date financial reports. Follow these steps to create a balance sheet in QuickBooks:

- Set Up Chart of Accounts: Before creating a balance sheet, ensure that you have set up the appropriate chart of accounts in QuickBooks. The chart of accounts includes the various categories and subcategories for tracking your company’s financial transactions. Make sure you have the relevant balance sheet accounts assigned, such as assets, liabilities, and equity accounts.

- Enter Financial Transactions: Record all relevant financial transactions in QuickBooks, including sales, expenses, purchases, and payments. It’s important to accurately classify each transaction using the appropriate account, ensuring that the balance sheet accounts are updated accordingly.

- Run a Balance Sheet Report: Once the transactions are entered, navigate to the Reports section in QuickBooks and select the Balance Sheet report. Customize the report settings based on your preferences, such as the reporting period and detail level.

- Review and Analyze the Balance Sheet: Once the balance sheet report is generated, review and analyze it to gain insights into your company’s financial position. Examine the assets, liabilities, and equity balances, comparing them to previous periods or industry benchmarks. This analysis will help you understand factors that contribute to your financial health, identify any discrepancies, and make informed business decisions.

- Make Adjustments if Needed: If you notice any discrepancies or errors in the balance sheet report, make the necessary adjustments in QuickBooks to ensure accuracy. This may involve correcting transaction categorizations, reconciling accounts, or addressing any issues identified during the analysis.

- Save and Share the Balance Sheet: Once the balance sheet is accurate and finalized, save it as a PDF or print a hard copy for record-keeping purposes. Additionally, you can share the balance sheet report with stakeholders such as investors, partners, or lenders to provide them with a clear snapshot of your company’s financial position.

Regularly creating and reviewing balance sheets in QuickBooks is essential for monitoring your company’s financial health and making informed financial decisions. By following these steps, you can ensure that your balance sheet accurately reflects the financial status of your business in QuickBooks.

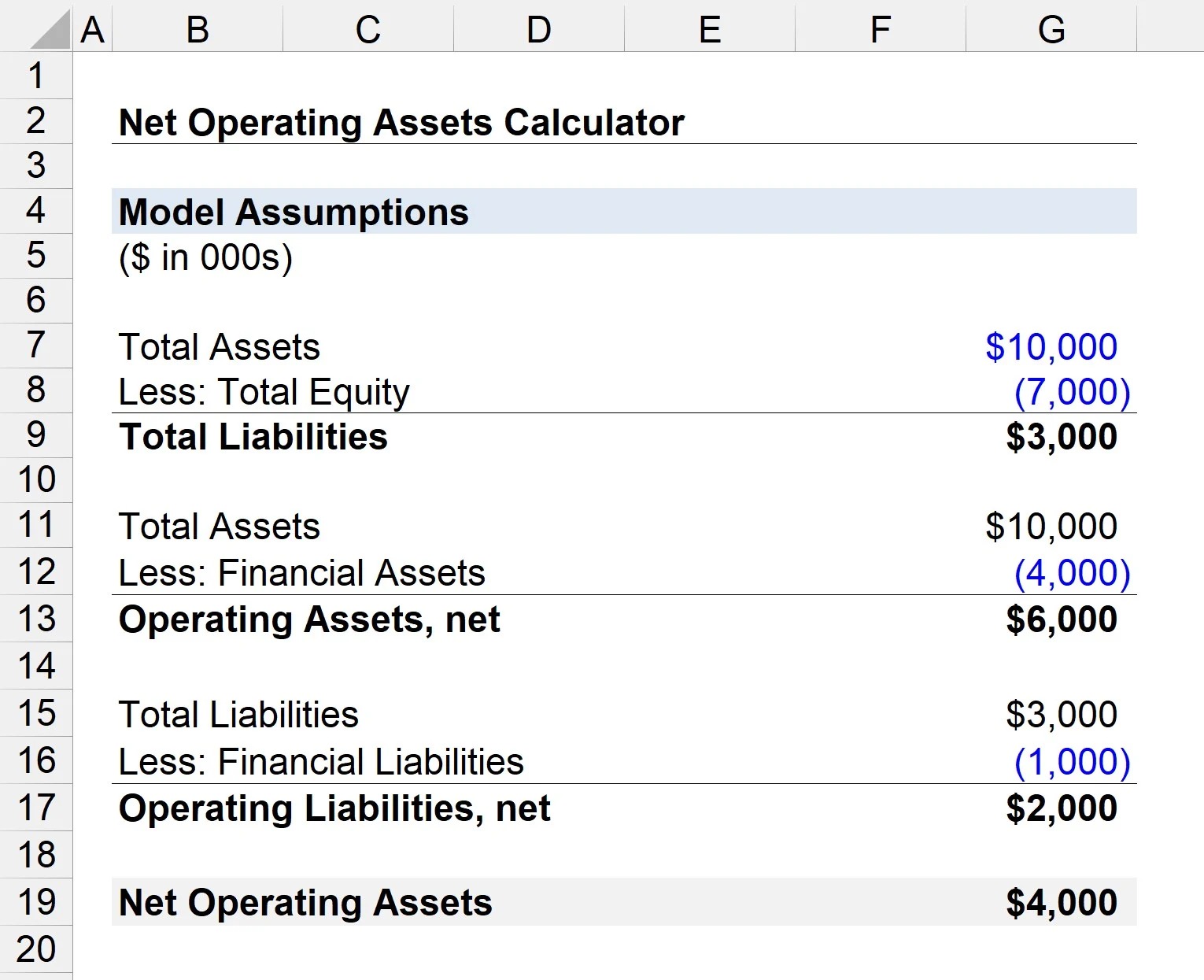

Analyzing a Balance Sheet in QuickBooks

Analyzing a balance sheet in QuickBooks is a critical step in understanding the financial health and stability of your business. By examining the various components and ratios derived from the balance sheet data, you can gain valuable insights that inform strategic decision-making. Here are some key factors to consider when analyzing a balance sheet in QuickBooks:

- Liquidity: Assessing the availability of liquid assets is crucial for short-term financial stability. QuickBooks balance sheets enable you to determine the adequacy of cash and current assets to cover short-term obligations. You can calculate liquidity ratios such as the current ratio (current assets divided by current liabilities) to determine your ability to meet short-term financial obligations.

- Solvency: QuickBooks allows you to evaluate the solvency of your business by examining the relationship between your total assets and total liabilities. The debt-to-equity ratio (total liabilities divided by total equity) can help assess the company’s risk exposure and financial leverage. A higher debt-to-equity ratio may indicate higher financial risk.

- Working Capital: Assessing working capital is crucial for understanding the day-to-day operational liquidity of your business. QuickBooks balance sheets provide insights into the availability of current assets to cover current liabilities. Positive working capital (current assets minus current liabilities) indicates the ability to meet short-term obligations and invest in growth opportunities.

- Asset Management: QuickBooks enables you to analyze the efficiency of asset utilization by examining various ratios. For example, the inventory turnover ratio (cost of goods sold divided by average inventory) helps you assess how quickly inventory is sold and replenished. Additionally, the accounts receivable turnover ratio (net credit sales divided by average accounts receivable) measures how efficiently you collect outstanding customer payments.

- Debt Management: QuickBooks balance sheets allow you to evaluate your company’s debt management by analyzing the debt ratio (total debt divided by total assets) and interest coverage ratio (earnings before interest and taxes divided by interest expense). These ratios provide insights into your company’s ability to manage debt and meet interest payment obligations.

- Profitability: While the balance sheet primarily focuses on the company’s financial position, it also provides information related to profitability. QuickBooks balance sheets can be used in tandem with other financial reports to analyze profitability ratios such as return on assets (net income divided by total assets) and return on equity (net income divided by total equity).

To effectively analyze your balance sheet in QuickBooks, it is important to compare current and past periods, benchmark against industry averages, and set goals. Regularly reviewing and understanding the financial indicators derived from your balance sheet reports will help you make informed business decisions, identify areas for improvement, and ensure the financial health and success of your business.

Conclusion

QuickBooks is a powerful tool for creating and analyzing balance sheets, providing businesses with valuable insights into their financial position and overall health. By understanding the purpose and components of a balance sheet in QuickBooks, users can effectively track and manage their assets, liabilities, and equity.

Creating a balance sheet in QuickBooks involves setting up the chart of accounts, entering financial transactions, and running a balance sheet report. This process allows businesses to accurately depict their financial standing and track changes over time. Analyzing the balance sheet in QuickBooks involves assessing liquidity, solvency, asset management, debt management, working capital, and profitability. These analyses enable businesses to make informed decisions, identify areas for improvement, and ensure financial stability.

Whether you are a small business owner managing your finances or an accounting professional seeking efficient solutions, QuickBooks offers a user-friendly platform for creating and analyzing balance sheets. By leveraging the capabilities of QuickBooks, you can enhance your financial management processes, gain valuable insights into your company’s financial health, and drive strategic decision-making.

In conclusion, QuickBooks empowers businesses to effectively manage their financial data and generate comprehensive balance sheet reports. By utilizing this robust software, businesses can gain a better understanding of their financial position, improve financial planning, and drive long-term success.