Finance

Where Is Notes Payable On Balance Sheet

Modified: December 30, 2023

Find out where notes payable is located on your balance sheet and gain a better understanding of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on understanding the placement of notes payable on the balance sheet. If you have ever looked at a balance sheet and wondered where notes payable fit into the equation, you’ve come to the right place. In this article, we will explore the definition of notes payable, the structure of a balance sheet, and the importance of notes payable in financial reporting.

Notes payable, also known as a promissory note or loan agreement, is a common financing tool used by businesses to borrow money from lenders. These notes represent a legal obligation to repay the borrowed funds, typically with interest, within a specified timeframe. As a result, notes payable play a significant role in a company’s financial obligations and are an essential component of a comprehensive balance sheet.

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a given point in time. It consists of three main sections: assets, liabilities, and shareholders’ equity. The assets represent what the company owns, liabilities reflect what the company owes, and shareholders’ equity represents the shareholders’ ownership interest in the business. The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity.

Now that we have a basic understanding of notes payable and the structure of a balance sheet, let’s delve into where notes payable are situated within the balance sheet. Understanding their placement is essential for evaluating a company’s financial health and its ability to meet its debt obligations.

Definition of Notes Payable

Notes payable, also referred to as promissory notes, are a type of financial instrument used by companies to borrow money from lenders. It represents a written agreement between the borrower and the lender, detailing the terms and conditions of the loan. The borrower, or the company, agrees to repay the borrowed funds within a specified period, along with any accrued interest.

Notes payable can be issued for various purposes, such as financing the purchase of assets, funding operations, or covering short-term cash flow needs. They are typically used when borrowing larger sums of money, beyond the capabilities of a typical accounts payable arrangement.

These notes serve as evidence of the company’s debt obligation and are legally binding. They contain essential details, including the principal amount borrowed, the interest rate, repayment terms, maturity date, and any other specific conditions agreed upon by both parties. The terms of the notes payable can vary depending on factors such as the creditworthiness of the borrower and prevailing market conditions.

Interest payments on notes payable can be fixed or variable, depending on the terms of the agreement. Fixed interest rates remain unchanged throughout the loan period, providing predictability in interest expenses. On the other hand, variable interest rates fluctuate based on an agreed-upon benchmark, such as a reference interest rate or the prime rate, offering flexibility but introducing the possibility of increased interest costs.

Notes payable are considered a liability on the balance sheet because they represent the company’s obligation to repay the borrowed funds within the specified timeframe. They are categorized as current liabilities if their repayment is due within one year or as long-term liabilities if repayment extends beyond one year.

It is important for businesses to manage their notes payable effectively to ensure timely repayment. Defaulting on these obligations can harm a company’s reputation and creditworthiness, making it more challenging to secure future financing. Additionally, notes payable and other debt obligations impact a company’s financial ratios, such as the debt-to-equity ratio and interest coverage ratio, which are closely scrutinized by creditors and investors.

Now that we have a clear understanding of what notes payable are, let’s explore how they are positioned on the balance sheet.

Structure of a Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is divided into three main sections: assets, liabilities, and shareholders’ equity.

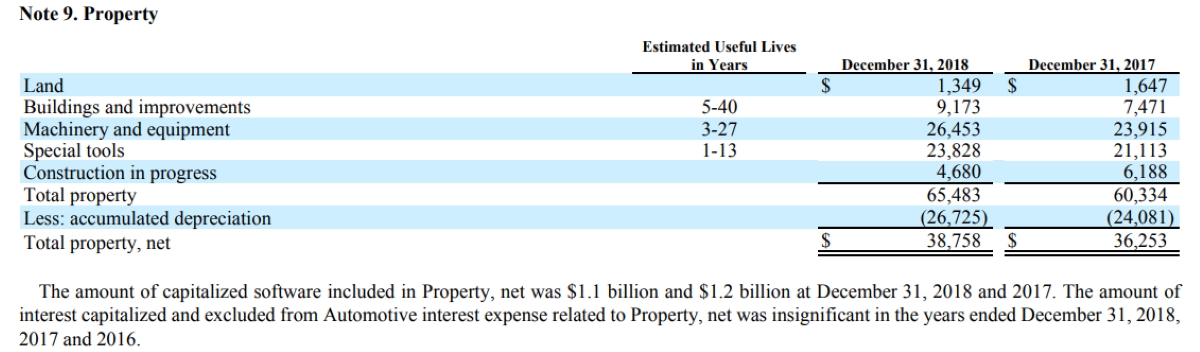

The assets section represents what the company owns or controls. It includes current assets, such as cash, accounts receivable, inventory, and prepaid expenses, which are expected to be converted into cash within one year. Long-term assets, such as property, plant, and equipment, intangible assets, and investments, reflect items with a longer useful life.

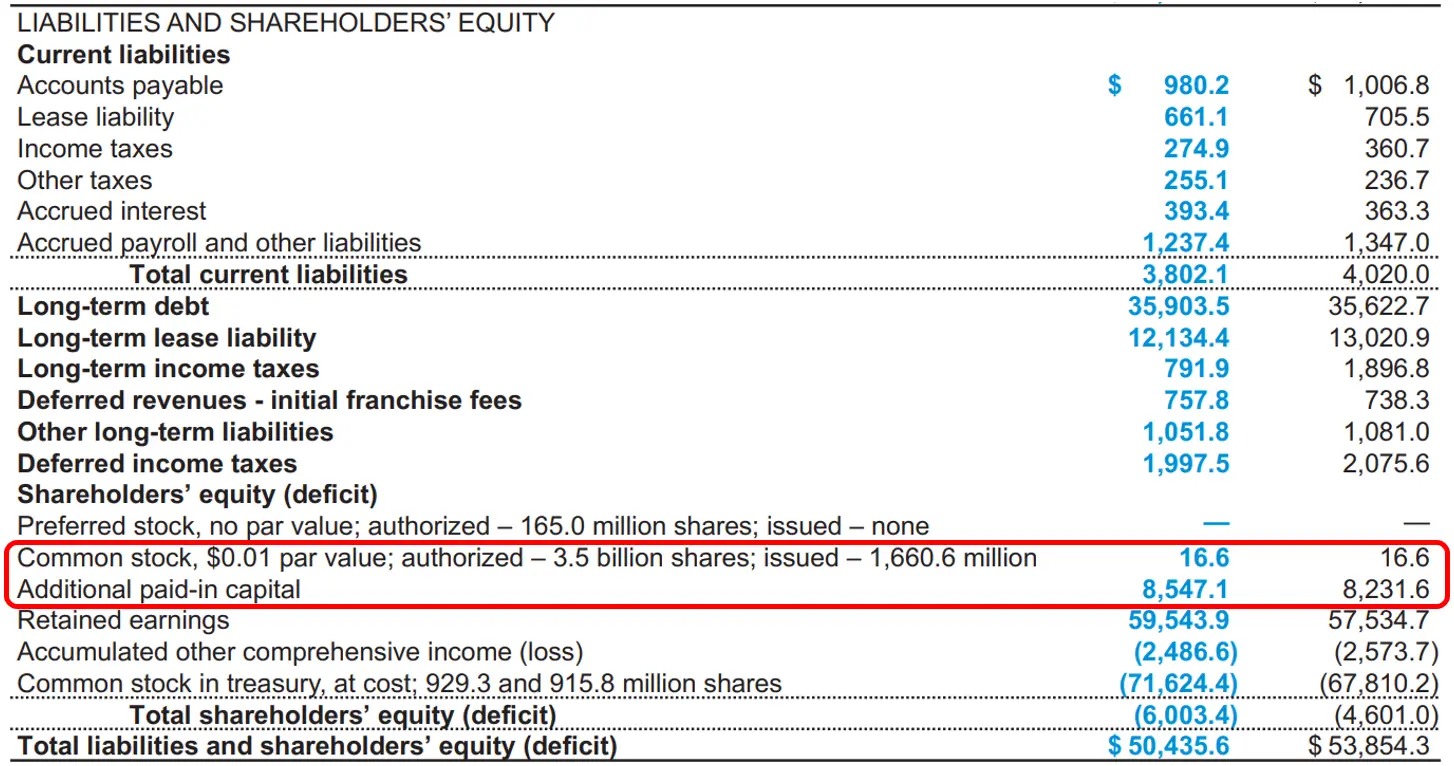

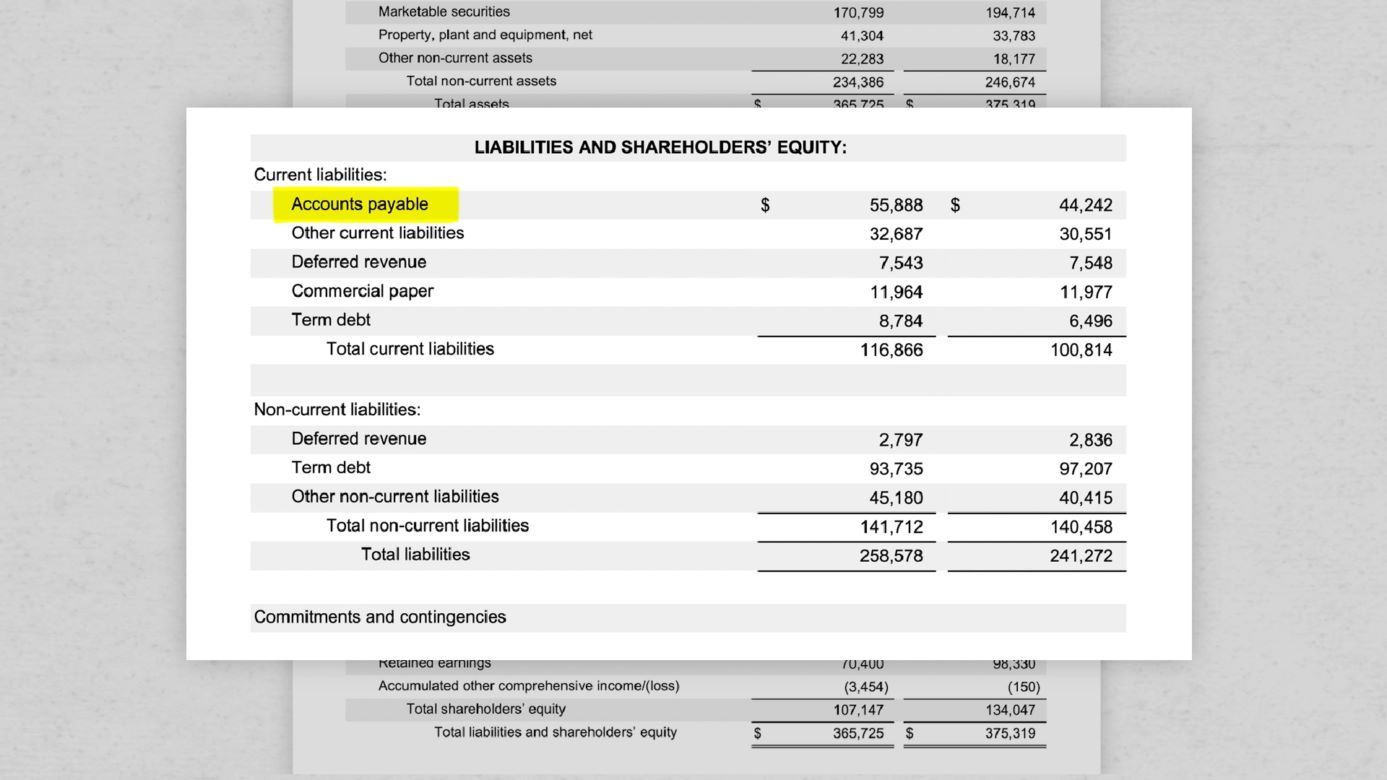

The liabilities section shows what the company owes to creditors and other financial obligations. Current liabilities, such as accounts payable, accrued expenses, and short-term loans, are generally due within one year. Long-term liabilities encompass obligations that extend beyond one year, such as long-term loans, mortgages, and bonds.

Lastly, shareholders’ equity represents the residual interest in the assets of the company after deducting liabilities. It includes the company’s retained earnings, which are the accumulated profits not distributed to shareholders as dividends, and any additional capital contributed by shareholders.

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity. This equation ensures that the balance sheet remains in balance, with the total value of assets equal to the combined value of liabilities and shareholders’ equity.

The structure of a balance sheet provides valuable insights into a company’s financial health and overall stability. It allows investors, creditors, and other stakeholders to assess the company’s liquidity, solvency, and the ability to meet its financial obligations.

Now that we understand the basic structure of a balance sheet, let’s explore where notes payable are typically located within this financial statement.

Placement of Notes Payable on the Balance Sheet

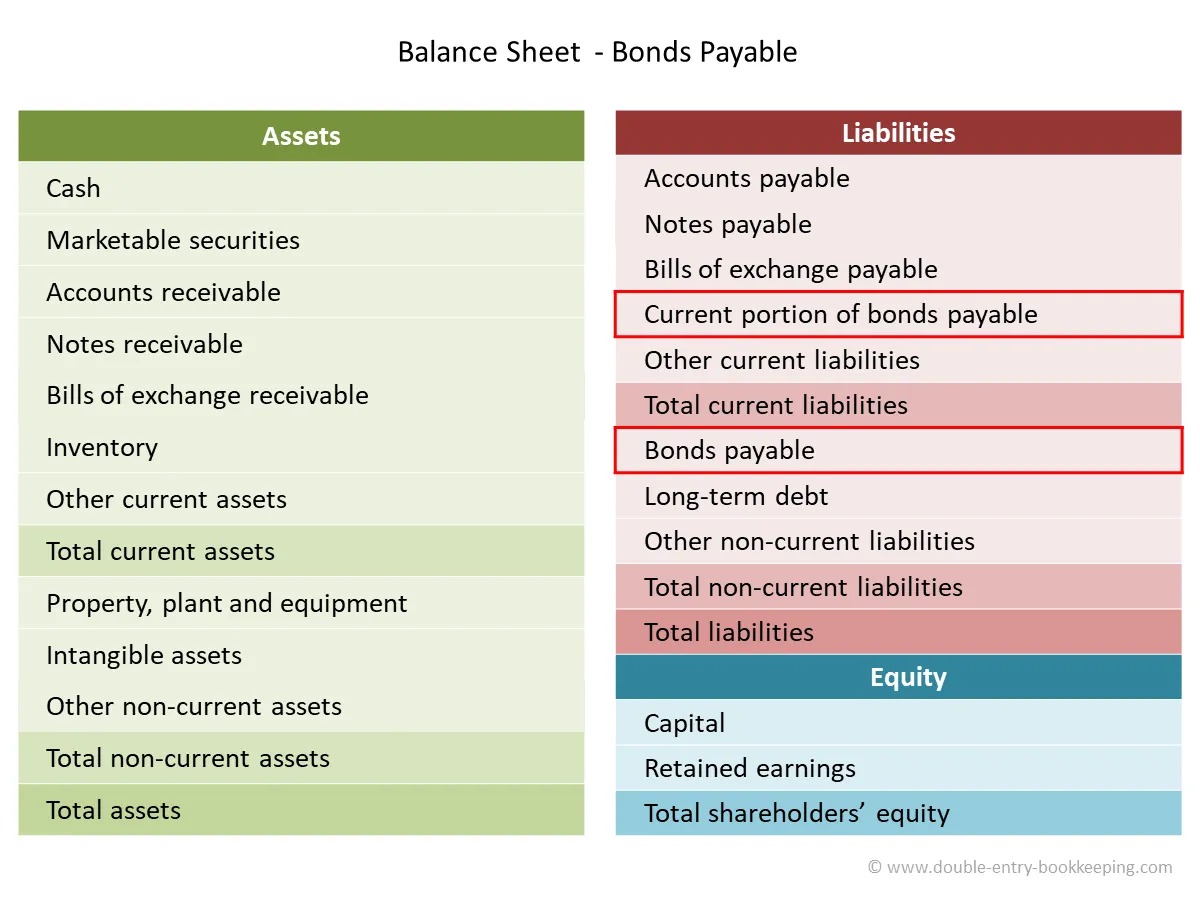

Notes payable, as a form of liability, are typically reported on the balance sheet under the “Liabilities” section. Within the liabilities section, notes payable can be further classified as either current liabilities or long-term liabilities, depending on their repayment terms.

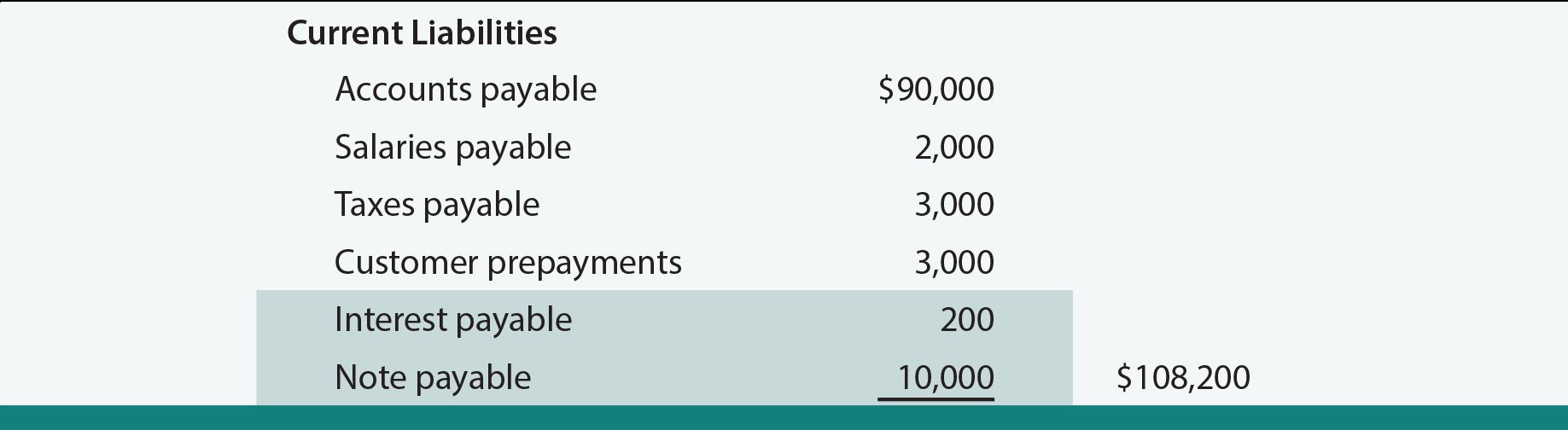

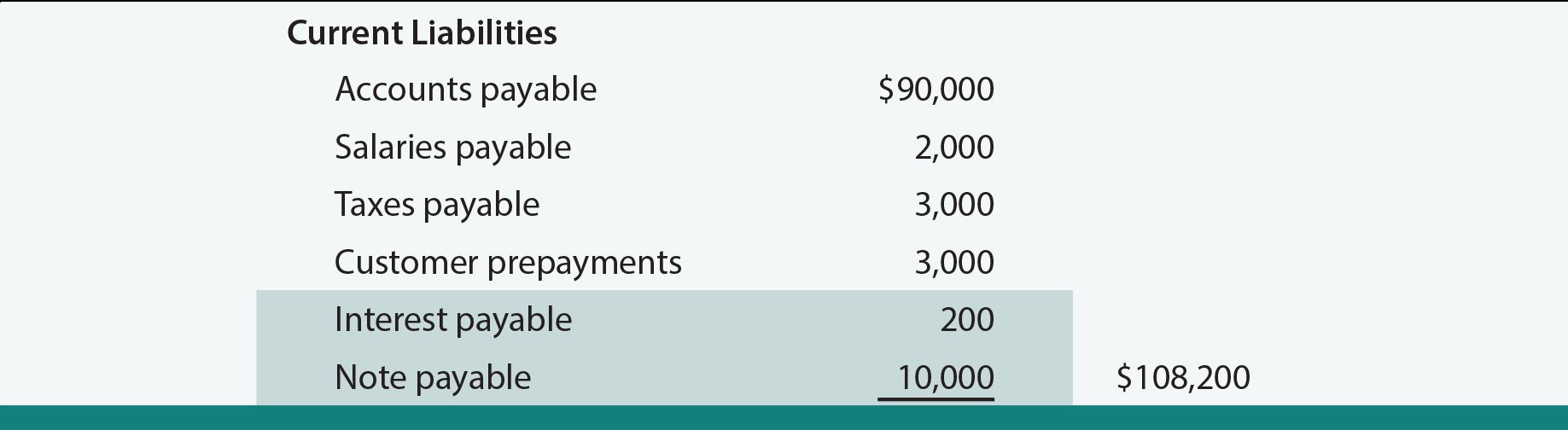

If a note payable is due within one year from the date of the balance sheet, it is considered a current liability. It will be listed under the “Current Liabilities” section, which includes other short-term obligations that the company is expected to fulfill within the next year. Examples of current liabilities may include accounts payable, accrued expenses, and short-term loans.

On the other hand, if a note payable has a repayment term exceeding one year, it falls under the category of long-term liabilities. These are obligations that are not due within the next year and are often associated with loans or financing arrangements that extend over an extended period. Long-term liabilities are typically found in a separate section of the balance sheet called “Long-term Liabilities” or “Non-Current Liabilities.” This section may also include items such as long-term loans, mortgages, and bonds.

The placement of notes payable within the liabilities section allows investors, creditors, and other interested parties to assess the company’s financial obligations and its ability to meet them. It provides a clear picture of the company’s short-term and long-term debt obligations, allowing stakeholders to evaluate its solvency and financial risk.

It is important to note that the order in which liabilities are presented on the balance sheet may vary depending on the reporting framework or accounting standards followed by the company. However, notes payable is typically given prominence due to its significance in representing the company’s borrowing activities and financial obligations.

Now that we have covered the placement of notes payable on the balance sheet, let’s explore the importance of notes payable in financial reporting.

Importance of Notes Payable on the Balance Sheet

Notes payable play a crucial role in financial reporting and provide valuable insights into a company’s financial health and borrowing activities. Here are some key reasons why notes payable are of importance on the balance sheet:

- Indicator of Debt Obligations: Notes payable represent the company’s debt obligations to lenders. They provide transparency regarding the amount of money borrowed and the terms and conditions of repayment. This information allows stakeholders to assess the company’s ability to manage its debt and meet its financial obligations.

- Liquidity Assessment: The presence of notes payable on the balance sheet helps stakeholders evaluate a company’s liquidity. A significant amount of notes payable may indicate higher leverage and potential difficulties in meeting short-term financial obligations. It is crucial for stakeholders to assess whether the company has sufficient cash flow and liquidity to service its debt.

- Debt Management and Financial Stability: The balance between notes payable and other liabilities on the balance sheet provides insights into a company’s debt management practices and financial stability. A well-balanced debt structure, with manageable interest rates and repayment terms, demonstrates prudent financial management and reduces the risk of financial distress.

- Assessment of Risk and Creditworthiness: Lenders, investors, and other stakeholders analyze the borrowing activities of a company to evaluate its creditworthiness and risk profile. The presence of notes payable on the balance sheet provides valuable information for these assessments, helping stakeholders make informed decisions regarding providing further credit or investing in the company.

- Analysis of Financial Ratios: Financial ratios, such as the debt-to-equity ratio and interest coverage ratio, are widely used to assess a company’s financial health. The inclusion of notes payable on the balance sheet is crucial for calculating these ratios accurately. These ratios provide insights into a company’s leverage, ability to cover interest expenses, and overall financial stability.

By including notes payable on the balance sheet, companies provide stakeholders with a comprehensive view of their borrowing activities, debt obligations, and overall financial position. This transparency is vital in fostering trust, aiding decision-making, and enabling the evaluation of a company’s financial soundness.

Now that we have discussed the importance of notes payable on the balance sheet, let’s conclude our article.

Conclusion

Understanding the placement of notes payable on the balance sheet is essential for assessing a company’s financial health, debt obligations, and borrowing activities. Notes payable, as a liability, are typically reported in the liabilities section of the balance sheet, either as current liabilities if due within one year or as long-term liabilities if due beyond one year.

By including notes payable on the balance sheet, companies provide stakeholders with critical information about their borrowing activities, debt management practices, and ability to meet financial obligations. It allows investors, creditors, and other interested parties to evaluate a company’s liquidity, solvency, and creditworthiness.

The presence of notes payable on the balance sheet helps in assessing a company’s risk profile, analyzing financial ratios, and making informed decisions about providing further credit or investing in the company. It provides insights into a company’s debt obligations and its ability to manage and service its debt responsibly.

In conclusion, notes payable are an essential component of a comprehensive balance sheet, aiding in the evaluation of a company’s financial stability, risk profile, and creditworthiness. By understanding their placement and significance on the balance sheet, stakeholders can make informed decisions and gain a deeper understanding of a company’s financial position.

We hope this article has provided you with a clear understanding of the placement of notes payable on the balance sheet and their importance in financial reporting.