Finance

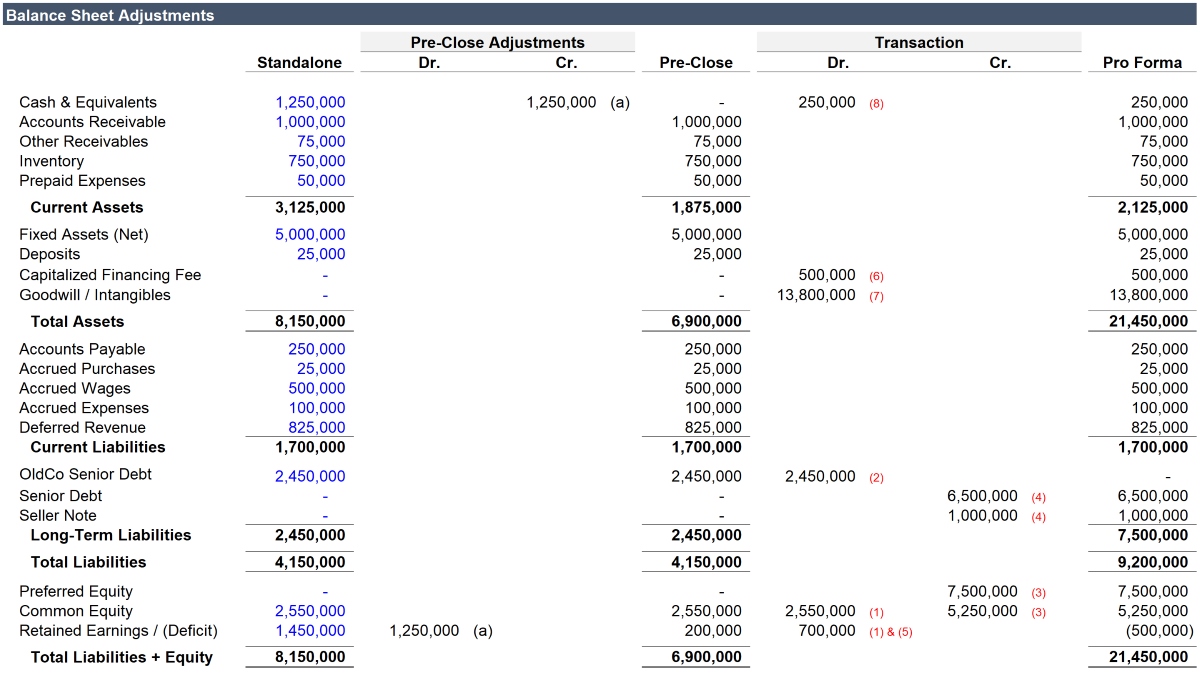

How To Create Balance Sheet

Published: December 27, 2023

Learn how to create a comprehensive balance sheet for your finance needs. Develop a clear understanding of your financial position and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial management, it’s essential to have a clear understanding of your company’s financial position. The balance sheet is a crucial financial statement that provides a snapshot of your business’s assets, liabilities, and equity at a specific point in time. This document not only allows you to evaluate your company’s financial health but also serves as a valuable tool for investors, creditors, and other stakeholders.

In this article, we will explore the intricacies of creating a balance sheet and the significance it holds in managing your business finances. By understanding the components and purpose of a balance sheet, you’ll be better equipped to make informed financial decisions and maintain financial stability for your company.

Whether you’re a small business owner, an accountant, or someone new to the world of finance, this article will serve as a comprehensive guide to creating a balance sheet that accurately reflects your company’s financial position and helps you plan for the future.

Definition of a Balance Sheet

A balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is also known as a statement of financial position or a statement of net worth. The balance sheet presents a summary of what a company owns (its assets), what it owes (its liabilities), and the difference between the two (its equity).

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity. This equation reinforces the concept that a company’s assets must be financed by either its liabilities or its equity. In other words, the balance sheet shows how a company funds its operations and whether it has the resources to meet its financial obligations.

The balance sheet is prepared at the end of an accounting period, typically quarterly or annually, and it provides a snapshot of the company’s financial position on that specific date. It is essential to note that the balance sheet represents a single moment in time and does not reflect changes in these financial variables over time.

The balance sheet is one of the three primary financial statements, along with the income statement and the cash flow statement. While the income statement focuses on a company’s profitability and the cash flow statement presents the inflows and outflows of cash, the balance sheet offers a detailed overview of a company’s assets, liabilities, and equity at a given point in time.

By analyzing the balance sheet, stakeholders can assess the financial health and stability of a company. It allows them to evaluate the company’s solvency, liquidity, and ability to generate long-term value. Potential investors, lenders, and creditors often rely on the balance sheet to make informed decisions about providing financial resources to a company.

Purpose of a Balance Sheet

The balance sheet serves several important purposes for a company and its stakeholders. Let’s explore its key functions:

1. Assessing Financial Position: The primary purpose of a balance sheet is to provide a clear snapshot of a company’s financial position at a specific moment in time. By presenting its assets, liabilities, and equity, the balance sheet allows stakeholders to assess the company’s overall financial health and stability.

2. Evaluating Solvency: Solvency refers to a company’s ability to meet its long-term obligations. The balance sheet helps stakeholders determine if a company has enough assets to cover its liabilities. By comparing total assets to total liabilities, investors, creditors, and potential partners can evaluate the solvency of a business.

3. Analyzing Liquidity: Liquidity is a measure of a company’s ability to meet its short-term financial obligations. The balance sheet provides valuable insights into a company’s current assets, such as cash and accounts receivable, which can be used to gauge its liquidity. This helps stakeholders determine whether a company can easily convert its assets into cash to cover immediate financial needs.

4. Tracking Equity: Equity represents the residual interest in a company’s assets after deducting liabilities. The balance sheet shows the equity contribution of the owners and shareholders. By monitoring changes in equity over time, stakeholders can assess the growth or decline in the company’s net worth and gauge its overall financial performance.

5. Making Informed Decisions: The balance sheet provides vital information for making informed business decisions. Investors and potential partners can use the balance sheet to assess the financial stability and potential risks associated with investing in a company. Creditors can evaluate the creditworthiness of a business before extending credit. Internal management can use the balance sheet to identify areas where resources can be allocated or invested strategically.

6. Compliance and Reporting: Companies are required by accounting standards and regulations to prepare and present balance sheets for external reporting purposes. The balance sheet plays a vital role in accurately disclosing a company’s financial position to regulators, tax authorities, and other external stakeholders.

In summary, the purpose of a balance sheet is to provide a comprehensive snapshot of a company’s financial position, assess solvency and liquidity, track equity, facilitate informed decision-making, and meet compliance requirements. By understanding the purpose of a balance sheet, businesses can effectively manage their finances and provide stakeholders with transparent information for decision-making.

Components of a Balance Sheet

A balance sheet is composed of three main components: assets, liabilities, and equity. Let’s take a closer look at each of these components:

- Assets: Assets are the resources owned by a company that have economic value and can be used to generate future benefits. They can be classified into current assets and non-current assets. Current assets are items that can be easily converted into cash within one year, such as cash, accounts receivable, inventory, and short-term investments. Non-current assets, on the other hand, are resources that are expected to provide benefits over a longer period, including property, plant, and equipment, long-term investments, and intangible assets like patents or trademarks.

- Liabilities: Liabilities represent the obligations and debts of a company that must be settled in the future. Similar to assets, liabilities can be divided into current liabilities and non-current liabilities. Current liabilities are the obligations that are expected to be paid off within one year, such as accounts payable, salaries payable, and short-term loans. Non-current liabilities, also known as long-term liabilities, are the obligations that extend beyond the next year, which may include long-term loans, mortgage payable, and deferred tax liabilities.

- Equity: Equity, also referred to as shareholders’ equity or net worth, represents the residual interest in the assets of the company after deducting liabilities. It is the ownership interest and claim on the company’s assets by the shareholders. Equity can be further categorized into contributed capital, which includes the investments made by shareholders, and retained earnings, which are the accumulated profits of the company that have not been distributed to shareholders as dividends.

It’s important to note that the total assets must always equal the total liabilities plus equity, as per the accounting equation: Assets = Liabilities + Equity. This balance ensures that the company’s financial position is accurately represented in the balance sheet.

By analyzing the components of a balance sheet, stakeholders can gain insights into a company’s financial health and stability. They can assess the liquidity and solvency of the company through the examination of its assets and liabilities. Equity provides information about the ownership and value of the company. Together, these components paint a comprehensive picture of a company’s financial position at a specific point in time.

Assets

In the context of a balance sheet, assets refer to the resources and properties that a company owns, which have economic value and can be utilized to generate future benefits. Assets are classified into two categories: current assets and non-current assets.

1. Current Assets: Current assets are items that can be converted into cash or are expected to be utilized or consumed within one year or the operating cycle of the business, whichever is longer. They are more liquid and easily turned into cash. Common examples of current assets include:

- Cash: This includes money held in bank accounts, cash on hand, and cash equivalents such as readily marketable securities. Cash allows a company to meet its short-term financial obligations and fund day-to-day operations.

- Accounts Receivable: Accounts receivable refers to the amounts owed to a company by its customers for goods or services provided on credit. It represents the company’s right to receive payment for these outstanding invoices.

- Inventory: Inventory represents the goods a company holds for sale or materials used in production. It includes raw materials, work-in-progress, and finished goods. Inventory is essential for businesses that manufacture or sell physical products.

- Prepaid Expenses: Prepaid expenses are amounts paid in advance for future goods or services. These can include prepaid insurance premiums, prepaid rent, or prepaid subscriptions. They are considered assets as they represent future economic benefits for the company.

- Short-term Investments: Short-term investments are financial instruments that can be easily converted into cash within a year. They include bonds, certificates of deposit, and money market funds. These investments provide the potential to earn interest or generate a return in the short term.

2. Non-current assets: Non-current assets, also known as long-term assets or fixed assets, are resources that are expected to provide economic benefits over a longer period, typically more than one year. Examples of non-current assets include:

- Property, Plant, and Equipment (PP&E): PP&E refers to tangible assets such as land, buildings, machinery, and vehicles that are used in the production or operation of the business. These assets are not expected to be easily converted into cash in the short term.

- Intangible Assets: Intangible assets are non-physical assets that represent the company’s intellectual property or rights. These may include trademarks, patents, copyrights, and brand recognition. Intangible assets contribute to a company’s competitive advantage and long-term value.

- Investments in Subsidiaries and Affiliates: Companies may have investments in other companies, known as subsidiaries or affiliates, which are held for strategic or financial reasons. These investments are typically long-term in nature.

- Long-term Investments: Long-term investments include investments in bonds, stocks, or other financial instruments that are expected to be held for an extended period and not easily converted into cash.

By analyzing the assets section of a balance sheet, stakeholders can gain insights into the company’s liquidity, operational capacity, and overall financial health. It helps determine the company’s ability to meet short-term obligations and assesses the value of long-term investments and resources.

Liabilities

Liabilities, in the context of a balance sheet, are obligations or debts that a company owes to external parties. They represent the financial claims or obligations that need to be settled in the future. Liabilities are classified into two main categories: current liabilities and non-current liabilities.

1. Current Liabilities: Current liabilities are obligations that are expected to be settled within one year or the operating cycle of the business, whichever is longer. They represent short-term financial obligations that a company must meet. Common examples of current liabilities include:

- Accounts Payable: Accounts payable refers to the amounts owed by a company to its suppliers for goods or services received on credit. It represents the company’s short-term liabilities for which payment is still pending.

- Short-term Loans and Credit: This encompasses loans, lines of credit, or other forms of borrowing that are expected to be repaid within one year.

- Accrued Expenses: Accrued expenses are liabilities that a company has incurred but has not yet paid. These could include salaries payable, taxes payable, and interest payable.

- Unearned Revenue: Unearned revenue, also known as deferred revenue, represents the money received by a company in advance for goods or services that have not yet been delivered. It is recorded as a liability until the company fulfills its obligation to provide the products or services.

- Short-term Portion of Long-term Debt: If a company has long-term debt, the portion that is due within the next year is classified as a current liability.

2. Non-current Liabilities: Non-current liabilities, also called long-term liabilities, are obligations that extend beyond the next year. These liabilities are not due for settlement in the short term and have a longer repayment period. Common examples of non-current liabilities include:

- Long-term Loans: These are loans or debt instruments that are scheduled to be repaid over a period that exceeds one year.

- Bonds Payable: Bonds payable are long-term debt instruments issued by a company to raise capital. They represent the company’s obligation to repay the principal amount and pay periodic interest to bondholders.

- Deferred Tax Liability: Deferred tax liability arises when a company has taxable temporary differences between its financial statements and tax records. It represents the future tax obligations that will be payable when these temporary differences reverse.

- Pension Obligations: Companies that provide pension plans to their employees may have long-term liabilities related to funding these retirement benefits.

- Lease Obligations: Lease obligations represent the long-term commitments a company has made for leasing assets, such as office space or equipment, under lease agreements.

The liabilities section of a balance sheet provides valuable insights into the company’s financial obligations and its ability to meet those obligations in the short and long term. It helps stakeholders understand the company’s debt structure, risk exposure, and financial stability.

Equity

Equity, also known as shareholders’ equity or net worth, represents the residual interest in a company’s assets after deducting its liabilities. It is the ownership claim on the company’s assets by the shareholders. Equity demonstrates the company’s value to its owners and shareholders.

Contributed Capital: Contributed capital is the portion of equity that represents the funds invested by shareholders or owners into the company. When a company issues shares of stock and receives money in exchange, it increases its contributed capital. This can include the initial investments made by founders or subsequent capital contributions made by shareholders.

Retained Earnings: Retained earnings reflect the accumulated profits of a company that have not been distributed to shareholders in the form of dividends. It represents the portion of the company’s earnings that has been retained and reinvested back into the business. Retained earnings increase when the company generates profits and decreases when dividends or other distributions are made to shareholders.

Treasury Stock: Treasury stock represents the shares of a company’s stock that have been repurchased from shareholders by the company itself. These repurchased shares are held by the company and not considered outstanding. Treasury stock is recorded as a deduction from the total equity and represents a reduction in ownership interest by existing shareholders.

Other Components of Equity: In addition to contributed capital, retained earnings, and treasury stock, equity may include other components such as accumulated other comprehensive income (AOCI) and minority interest. AOCI represents unrealized gains or losses that are not included in the income statement but rather reported as a separate component of equity. Minority interest refers to the portion of equity owned by minority shareholders in subsidiaries or divisions of the company.

Equity provides insight into a company’s financial health, ownership structure, and value creation. It represents the claims of the shareholders on the company’s assets and reflects the accumulated net worth and reinvested earnings of the business. Equity is a critical component of the balance sheet that stakeholders use to assess a company’s value, ownership interests, and overall financial performance.

Accounting Equation

The accounting equation is a fundamental concept in accounting that serves as the foundation for preparing financial statements, including the balance sheet. It is a simple yet powerful equation that showcases the relationship between a company’s assets, liabilities, and equity.

The accounting equation is expressed as:

Assets = Liabilities + Equity

This equation emphasizes the idea that a company’s assets are financed by either its liabilities, which represent the company’s obligations to external parties, or the equity contributed by its owners or shareholders.

Let’s break down each component of the accounting equation:

- Assets: Assets represent the resources and properties owned by a company that have economic value. They include cash, accounts receivable, inventory, property, plant and equipment, and intangible assets. Assets are categorized into current assets, which are expected to be converted into cash within one year, and non-current assets, which are held for longer-term use or value creation.

- Liabilities: Liabilities are the debts and financial obligations of a company to external parties. They encompass amounts owed to suppliers, salaries payable, loans, and other liabilities. Like assets, liabilities are divided into current liabilities, which are due within one year, and non-current liabilities, which have a longer repayment period.

- Equity: Equity, also known as shareholders’ equity or net worth, represents the residual interest in a company’s assets after deducting liabilities. It reflects the ownership claim on the company’s assets by the shareholders. Equity consists of contributed capital, which is the amount invested by shareholders, and retained earnings, which are the accumulated profits of the company that have not been distributed as dividends.

The accounting equation is based on the principle of double-entry bookkeeping, which requires every transaction to have equal debits and credits. This ensures that the equation remains in balance. For example, if a company purchases inventory for cash, the asset (inventory) increases, and the asset (cash) decreases, keeping the equation balanced.

The accounting equation is a fundamental concept that allows businesses to track and report their financial position accurately. It serves as the basis for preparing the balance sheet, which provides stakeholders with a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Understanding the accounting equation is crucial for financial analysis, decision-making, and ensuring the accuracy of financial reporting.

Format and Presentation of a Balance Sheet

The balance sheet is a financial statement that presents a company’s financial position at a specific date. It follows a standardized format to provide a clear and organized representation of a company’s assets, liabilities, and equity. The format of a balance sheet typically consists of two main sections: the left side and the right side.

Left Side: The left side of the balance sheet presents the company’s assets. Assets are categorized into current assets and non-current assets, with current assets listed first. This arrangement reflects the liquidity and the order in which assets can be converted into cash.

The current assets section typically includes items such as cash, accounts receivable, inventory, and short-term investments. Non-current assets, which include long-term investments, property, plant and equipment, and intangible assets, follow the current assets.

Right Side: The right side of the balance sheet displays the company’s liabilities and equity. Liabilities are presented before equity and are categorized into current liabilities and non-current liabilities, mirroring the order of assets on the left side.

The current liabilities section includes obligations such as accounts payable, short-term loans, accrued expenses, and unearned revenue. Non-current liabilities, such as long-term loans, bonds payable, and deferred tax liabilities, are listed after the current liabilities.

After the liabilities, the equity section is presented. Equity consists of contributed capital and retained earnings, which are further divided into subcategories if necessary. The equity section represents the ownership interest and value of the company held by the shareholders.

Within each section of the balance sheet, the specific accounts and their respective balances are listed. The accounts are typically presented in descending order of liquidity, with the most liquid assets or closest-to-maturity liabilities listed first.

The balance sheet should include a clear heading that states the company name, the title “Balance Sheet,” and the specific date for which the financial position is being reported. Additionally, it is common to include comparative balance sheets from previous periods to allow stakeholders to analyze changes in the company’s financial position over time.

The format and presentation of a balance sheet ensure consistency and comparability across different companies and reporting periods. By following the standardized format, the balance sheet provides stakeholders with a clear and structured overview of a company’s financial position, making it easier to analyze and evaluate its performance and stability.

Importance of a Balance Sheet

The balance sheet is a vital financial statement that holds significant importance for businesses and their stakeholders. It provides valuable insights into a company’s financial health, stability, and overall position. Let’s explore the key reasons why the balance sheet is so important:

1. Financial Health Assessment: The balance sheet allows stakeholders to assess a company’s financial health by providing a snapshot of its assets, liabilities, and equity. It provides a clear picture of the company’s financial standing at a specific point in time, helping investors, lenders, and creditors evaluate its ability to meet financial obligations, manage debts, and generate profits.

2. Solvency Evaluation: Solvency refers to a company’s ability to meet its long-term financial obligations. The balance sheet plays a crucial role in assessing solvency by comparing a company’s total assets to its total liabilities. This analysis helps stakeholders determine if a company has sufficient assets to cover its debts and obligations beyond the current year.

3. Liquidity Assessment: The balance sheet provides information on a company’s current assets and current liabilities, enabling stakeholders to evaluate its liquidity. Liquidity measures a company’s ability to meet short-term financial obligations. By analyzing the balance sheet, stakeholders can assess whether the company has enough liquid assets, such as cash and accounts receivable, to cover its immediate financial needs.

4. Financial Decision Making: The balance sheet plays a crucial role in financial decision making. It provides essential information for stakeholders to make informed investment decisions, evaluate creditworthiness, and determine potential risks. The balance sheet helps management allocate resources, plan for future growth, and identify areas where the company’s financial position can be strengthened.

5. Investor Confidence: Investors rely on the balance sheet to gain insights into a company’s financial stability, value, and growth potential. A strong balance sheet, with healthy asset levels, lower liabilities, and strong equity position, instills confidence in investors and may attract more investment opportunities.

6. Regulatory Compliance: Companies are required by accounting standards and regulations to prepare and present balance sheets as part of their financial reporting obligations. The balance sheet ensures compliance with these regulations and provides transparency to regulatory authorities, tax agencies, and other external stakeholders.

7. Performance Analysis: Comparative balance sheets over different periods allow stakeholders to analyze a company’s financial performance and trends. By examining changes in assets, liabilities, and equity, stakeholders can identify areas of growth, potential risks, and areas for improvement.

8. Creditor Evaluation: Creditors, such as banks or suppliers, rely on the balance sheet to assess a company’s creditworthiness and repayment capacity. By examining a company’s liabilities and equity, creditors can evaluate the level of risk associated with lending to the company and make informed decisions regarding credit extension.

In summary, the balance sheet is of utmost importance to businesses and their stakeholders. It provides a detailed and comprehensive view of a company’s financial position, allowing stakeholders to evaluate financial health, solvency, liquidity, make informed decisions, and foster transparency and accountability.

Conclusion

The balance sheet is a critical financial statement that provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It serves as a valuable tool for assessing a company’s financial health, stability, and overall position. By understanding and analyzing the components of a balance sheet, stakeholders can make informed decisions, evaluate solvency and liquidity, and gain insights into a company’s financial performance and potential risks.

Through its standardized format and presentation, the balance sheet enables stakeholders to compare the financial position of different companies and track changes in a company’s financial position over time. It is an essential source of information for investors, creditors, regulators, and other stakeholders to evaluate a company’s creditworthiness, make investment decisions, and assess its ability to meet financial obligations.

Additionally, the balance sheet aids in financial decision-making, as it provides crucial information for resource allocation, strategic planning, and forecasting. It helps management assess the level of equity investment, evaluate the impact of debt, and identify areas where the company can improve its financial position.

Furthermore, the balance sheet ensures compliance with accounting standards and regulations, providing transparency to regulators and tax authorities. It fosters accountability and transparency by disclosing a company’s financial position to external stakeholders, contributing to investor confidence and trust.

In conclusion, the balance sheet is a vital tool for understanding a company’s financial position, evaluating its stability and performance, and making informed decisions. It is an essential component of financial reporting and serves as a key resource for stakeholders to assess a company’s financial health, solvency, liquidity, and overall value. By utilizing the balance sheet effectively, businesses can navigate financial challenges, attract investments, and drive sustainable growth.