Finance

What Are Intangible Assets On A Balance Sheet

Modified: December 30, 2023

Discover the importance of intangible assets on a balance sheet in finance. Gain insights into their impact on business value and financial performance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Intangible Assets

- Examples of Intangible Assets

- Importance of Intangible Assets on a Balance Sheet

- Valuation of Intangible Assets

- Recognition and Measurement of Intangible Assets

- Reporting Intangible Assets on a Balance Sheet

- Implications for Financial Analysis

- Challenges and Limitations of Intangible Asset Reporting

- Conclusion

Introduction

In today’s highly competitive business landscape, companies possess a multitude of assets that contribute to their overall value. While tangible assets such as buildings, equipment, and inventory are easily recognizable and accounted for on a balance sheet, there is another category of assets that often goes unnoticed – intangible assets. These assets, though lacking a physical presence, can be equally if not more valuable to a company’s success.

Intangible assets are non-physical assets that hold value due to their intellectual or legal rights. Unlike tangible assets, intangibles cannot be touched or seen but are vital in generating revenue, increasing market share, and enhancing a company’s competitive advantage. They encompass a broad range of assets, including patents, copyrights, trademarks, brand names, customer lists, software, specialized knowledge, and even goodwill.

What sets intangible assets apart is their ability to provide long-term benefits to a company, often extending well beyond the current reporting period. While tangible assets depreciate over time, intangibles can appreciate in value, making them an essential consideration for investors, analysts, and company stakeholders.

Definition of Intangible Assets

Intangible assets are non-physical resources that provide long-term economic benefits to a company. These assets lack a physical form but possess inherent value due to their intellectual or legal rights. They are not tangible items that can be touched or seen, but they still contribute significantly to a company’s profitability and overall worth.

There are various types of intangible assets that a company can possess. These include intellectual property such as patents, trademarks, and copyrights that protect the company’s innovative ideas, inventions, and creative works from unauthorized use. Brand names and logos, which represent a company’s reputation and customer loyalty, are also considered intangible assets.

Customer relationships and customer lists are another form of intangible assets. These represent the value a company derives from its existing customer base and the potential for future sales. This includes customer data, contact information, and purchasing history, which can be leveraged to enhance marketing strategies and drive customer engagement.

In addition, proprietary technology, software, trade secrets, and know-how can all be classified as intangible assets. These assets provide a competitive advantage by offering unique processes, expertise, or tools that are not easily replicated by competitors.

Lastly, goodwill is an intangible asset that arises from business acquisitions. It represents the premium paid to acquire a company beyond its net tangible assets. Goodwill reflects the value of the acquired company’s reputation, customer relationships, and other intangible factors that contribute to future earnings potential.

It is important to note that not all intangible assets are recorded on a company’s balance sheet. Only the ones that are acquired or have a determinable value are recognized. Internally generated intangibles, such as research and development costs or employee training, are typically expensed rather than capitalized and are not included in the balance sheet.

Examples of Intangible Assets

Intangible assets come in various forms, each contributing to a company’s value in different ways. Here are some examples of common types of intangible assets:

- Intellectual Property: This includes patents, trademarks, and copyrights. Patents protect new inventions or innovative processes, giving the owner exclusive rights for a specified period. Trademarks, on the other hand, protect brand names, logos, and slogans, distinguishing a company’s products or services from competitors. Copyrights safeguard original creative works such as songs, books, or movies, preventing unauthorized reproduction of the content.

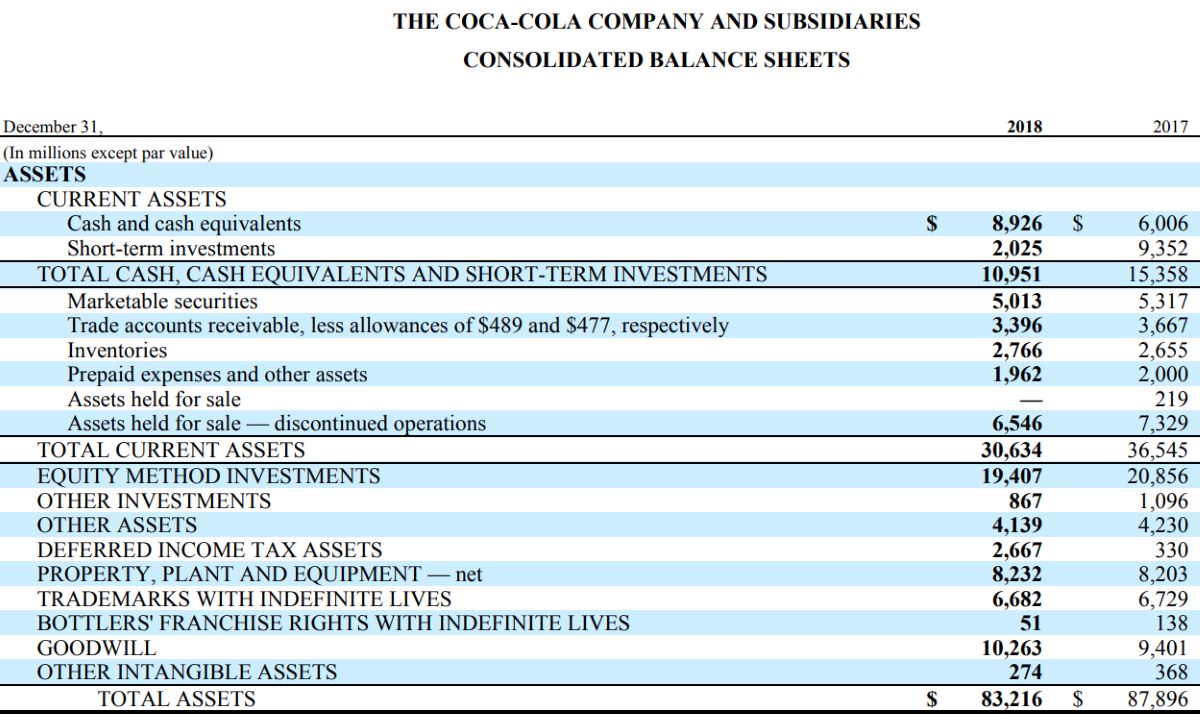

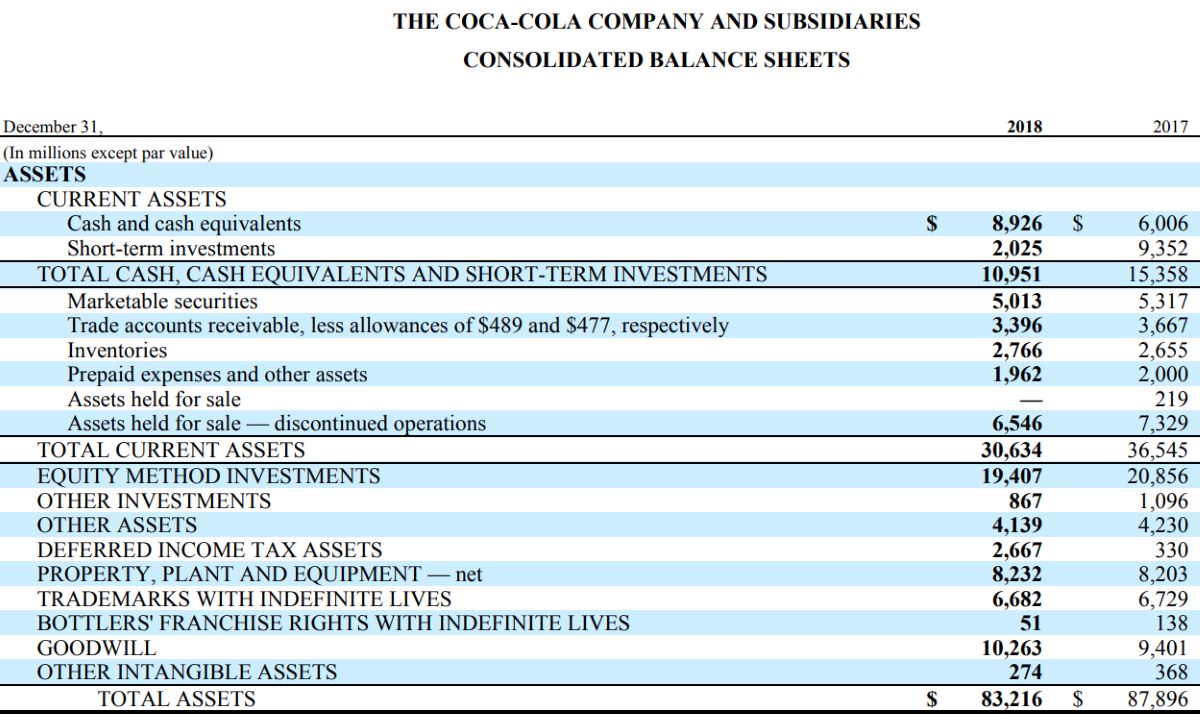

- Brand Names and Logos: Well-established brands have substantial value as intangible assets. Brand recognition and reputation play a critical role in attracting and retaining customers. Examples of valuable brand names include Coca-Cola, Nike, and Apple.

- Customer Relationships: Customer relationships built over time translate into loyal patrons and repeat business. Customer databases, loyalty programs, and subscription services are examples of intangible assets that enhance customer retention and provide a competitive advantage.

- Proprietary Technology and Software: Companies that develop proprietary technology or software gain a competitive edge by offering unique features or functionalities. Examples include software applications, customer relationship management (CRM) systems, or proprietary algorithms.

- Trade Secrets: Trade secrets are valuable pieces of undisclosed information that provide a competitive advantage. They can include manufacturing processes, formulas, or customer lists that are kept confidential to maintain a market advantage.

- Goodwill: Goodwill represents the value of a company’s reputation, brand recognition, and customer loyalty. It arises from business acquisitions where the purchase price exceeds the net tangible assets. Goodwill is an intangible asset that reflects the additional value associated with the acquired company.

These examples highlight the broad range of intangible assets that companies possess. It is crucial for businesses to recognize and manage these assets effectively to safeguard their competitive position and long-term profitability.

Importance of Intangible Assets on a Balance Sheet

Intangible assets play a crucial role in determining a company’s overall value and financial position. While tangible assets are easily identifiable and quantifiable, intangible assets often hold significant value, even though they lack a physical presence. Here are some key reasons why intangible assets are important on a balance sheet:

- Significant Contribution to Market Value: Intangible assets can often represent a substantial portion of a company’s total value. For example, the brand value of a company like Apple or Coca-Cola greatly exceeds the value of their physical assets. Including intangible assets on a balance sheet provides a more accurate representation of a company’s true worth.

- Long-Term Revenue Generation: Intangible assets have the potential to generate revenue for an extended period. Patents, for instance, protect a company’s unique inventions, ensuring a monopoly in the market and enabling the generation of royalties from licensing agreements. Including these revenue-generating intangible assets on the balance sheet provides insight into a company’s sustainable income streams.

- Competitive Advantage and Market Positioning: Intangible assets such as trademarks, brand names, and customer relationships contribute to a company’s competitive advantage and market positioning. These assets enhance brand recognition, customer loyalty, and market share, providing a clear edge over competitors. By including these intangibles on the balance sheet, investors and stakeholders can better evaluate a company’s ability to maintain its competitive position.

- Attractiveness to Investors: Investors seek companies with strong intangible assets as these assets can drive long-term profitability. Companies with valuable patents, proprietary technology, or well-known brands are often seen as more attractive investment opportunities. By disclosing intangible assets on the balance sheet, companies can provide investors with a clearer picture of their intangible asset portfolio and potential for future growth.

- Measurement of Business Performance: Including intangible assets on a balance sheet allows for a more comprehensive assessment of a company’s financial performance. By understanding the contribution of intangible assets to revenue generation and profitability, investors and analysts can make more informed decisions regarding a company’s financial health and growth prospects.

In summary, intangible assets are of crucial importance for companies and their inclusion on the balance sheet provides a more accurate representation of a company’s overall value and financial position. Recognizing and appropriately valuing these assets allows companies to demonstrate their competitive advantage, attract investors, and provide a comprehensive assessment of their financial performance.

Valuation of Intangible Assets

Valuing intangible assets can be complex, as they lack a physical nature and their worth is often subjective. Nevertheless, accurately valuing these assets is crucial for financial reporting and decision-making. Here are some common methods used to value intangible assets:

- Market Approach: This approach relies on comparing the intangible asset to similar assets that have been recently sold in the market. Market data such as licensing agreements, royalties, or sales of comparable assets are used as benchmarks to determine the value of the asset.

- Income Approach: The income approach values an intangible asset based on the income it is expected to generate. This approach estimates the future cash flows that the asset will generate and discounts them to present value using an appropriate discount rate. Methods such as the discounted cash flow (DCF) analysis are commonly used.

- Cost Approach: The cost approach values an intangible asset based on the cost to recreate or replace it, taking into account any adjustments for obsolescence or deterioration. This method is commonly used for intangibles such as software, where the cost of development is considered.

- Comparable Transactions: In certain cases, the value of an intangible asset can be estimated by examining similar transactions in which the asset was bought or sold. This method looks at the terms and conditions of those transactions to determine an appropriate value for the asset in question.

It is important to note that intangible asset valuation is subjective and can vary depending on factors such as the asset’s uniqueness, market demand, and competitive landscape. Additionally, the timing of the valuation is crucial, as the value of some intangible assets may change over time due to factors such as technological advancements or changes in customer preferences.

Professional appraisers with expertise in valuing intangible assets are often hired to provide an objective evaluation. Their experience and knowledge can help ensure that the valuation is accurate and reliable. Companies should also consider the guidance provided by accounting standards, regulatory bodies, and industry practices when valuing intangible assets.

In summary, the valuation of intangible assets requires careful consideration and the application of appropriate valuation methods. By accurately valuing these assets, companies can provide transparency in their financial reporting and make informed decisions regarding asset management, acquisitions, and strategic planning.

Recognition and Measurement of Intangible Assets

Recognition and measurement of intangible assets are crucial for accurately reporting a company’s financial position and performance. Accounting guidelines provide specific guidance on how to recognize and measure these assets. Here are the key considerations:

Recognition: Intangible assets are recognized on the balance sheet when certain conditions are met. They must be identifiable, meaning they are separable from the company and can be sold, transferred, or licensed. Additionally, the asset must have a reliable measure of cost or fair value. Acquired intangible assets are generally recognized at their fair value, which is the price that would be received to sell the asset in an orderly transaction between market participants.

Measurement: The measurement of intangible assets depends on whether they are acquired or internally generated.

- Acquired Intangible Assets: Acquired intangibles are measured at their cost, including any direct or indirect acquisition costs. This includes the purchase price, legal fees, and other expenses directly attributable to acquiring the asset. If the acquisition involves a business combination, the intangible assets are measured at fair value as of the acquisition date.

- Internally Generated Intangible Assets: Internally generated intangible assets, such as research and development (R&D) costs, are generally expensed as incurred. This is because it is often difficult to reliably measure the costs and potential future benefits of internally generated assets. However, certain development costs related to software or other intangible assets may be capitalized if specific criteria are met, such as technical feasibility, the intention to complete, and the ability to generate future economic benefits.

It is important to note that intangible assets with indefinite useful lives, such as trademarks or brands, are not amortized but tested for impairment annually or whenever there is an indication of potential impairment. Assets with finite useful lives, such as patents or customer contracts, are amortized over their estimated useful life.

Companies are required to disclose relevant information about their intangible assets in the notes to the financial statements. This includes details about the nature of the assets, their useful lives or amortization periods, methods used to determine fair value, and any restrictions on the use of the assets.

In summary, the recognition and measurement of intangible assets depend on their nature, whether they are acquired or internally generated. By adhering to the accounting guidelines and disclosing relevant information, companies provide transparency and ensure accurate reporting of their intangible assets. This enables investors, stakeholders, and analysts to make informed decisions about a company’s financial health and overall value.

Reporting Intangible Assets on a Balance Sheet

Intangible assets are an essential component of a company’s overall value and should be reported accurately on the balance sheet. They are typically classified as non-current assets since they provide long-term economic benefits. Here are the key considerations for reporting intangible assets on a balance sheet:

Identification and Description: Each intangible asset should be clearly identified and described on the balance sheet. This includes the type of asset, any associated legal or intellectual property rights, and relevant details that help stakeholders understand the nature of the asset.

Valuation: Intangible assets should be reported at their fair value or the cost of acquisition, depending on the circumstances. If an intangible asset has a finite useful life, it should be reported net of accumulated amortization or depreciation.

Separate Reporting: Depending on the applicable accounting standards, intangible assets may need to be separately itemized on the balance sheet. For example, brands, patents, or customer lists may be presented as individual line items, allowing stakeholders to assess the contribution of each intangible asset to the company’s overall value.

Disaggregated Information: Companies may be required to provide additional information in the notes to the financial statements. This can include details about the useful lives, amortization methods, key assumptions used in determining fair value, and any contingent obligations related to the intangible assets.

Disclosure of Impairment: If there are indications of impairment, companies must assess the recoverability of their intangible assets. If impairment is determined, the carrying value of the asset should be reduced and a corresponding impairment loss should be recognized. The impairment loss and any subsequent changes in the asset’s carrying value should be disclosed in the financial statements.

It is important for companies to follow applicable accounting standards and regulatory requirements when reporting intangible assets on their balance sheet. The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) provide guidelines on how to recognize, measure, and disclose intangible assets to ensure consistency and comparability across companies.

By accurately reporting and disclosing intangible assets on the balance sheet, companies provide stakeholders with valuable information about the company’s intangible asset portfolio, their contribution to overall value, and any potential risks or impairments that may affect future financial performance.

Implications for Financial Analysis

Intangible assets have significant implications for financial analysis, as they can provide valuable insights into a company’s growth potential, competitive advantage, and overall financial health. Including intangible assets in financial analysis allows stakeholders to gain a more comprehensive understanding of a company’s value and future prospects. Here are some key implications for financial analysis:

- Enhanced Valuation: Including intangible assets in the analysis provides a more accurate valuation of a company. These assets, such as brand names, patents, and customer relationships, can significantly contribute to a company’s long-term profitability and market position. Ignoring intangible assets would lead to an incomplete valuation and potential misjudgment of a company’s worth.

- Competitive Positioning: Intangible assets reflect a company’s competitive advantage and market positioning. Analyzing the types and quality of a company’s intangible assets can help determine its ability to attract and retain customers, differentiate products or services, and capture market share. This information is crucial for assessing a company’s long-term sustainability and growth prospects.

- Identifying Risks and Opportunities: Intangible assets can help identify potential risks and opportunities in the market. For example, the expiration of a key patent or the loss of a significant customer relationship could pose risks to a company’s revenue stream. Conversely, the acquisition of valuable intangibles or the development of innovative technologies could present growth opportunities. Recognizing and analyzing these assets assists in evaluating the potential impact on a company’s financial performance.

- Comparative Analysis: Intangible assets allow for more meaningful comparisons across companies within the same industry. Understanding the intangible assets held by competitors provides insights into their strengths and weaknesses. Comparing the allocation and utilization of intangible assets among different companies can help assess their relative competitive positions and identify areas for improvement.

Financial analysis should consider both tangible and intangible assets to provide a holistic view of a company’s financial performance and prospects. By incorporating intangible assets into analytical models and evaluating their impact, stakeholders can make better-informed investment decisions, assess a company’s ability to generate future cash flows, and understand its long-term sustainability in the market.

Challenges and Limitations of Intangible Asset Reporting

While recognizing and reporting intangible assets on the balance sheet is essential for transparency and accurate financial reporting, there are several challenges and limitations associated with intangible asset reporting. These challenges can affect the reliability and comparability of financial statements. Here are some key challenges and limitations:

- Subjectivity in Valuation: Valuing intangible assets can be subjective, as their worth is often based on estimates and assumptions. This subjectivity can lead to different valuations and potential inconsistencies across companies, making it challenging to compare and analyze financial statements.

- Lack of Standardization: Unlike tangible assets, there is no standardized method for valuing all types of intangible assets. This lack of standardization can result in differences in valuation methods and practices between industries and companies, making it difficult to compare intangible asset values across entities.

- Measurement Challenges: Some types of intangible assets, such as brand value or customer relationships, are inherently difficult to measure accurately. Determining their fair value or useful life can be challenging, leading to potential inconsistencies and uncertainties in financial reporting.

- Limited Disclosure: Companies may not disclose detailed information about their intangible assets, especially internally generated ones. This limited disclosure can make it difficult for users of financial statements to fully understand the nature and value of a company’s intangible assets.

- Rapidly Changing Value: The value of certain intangible assets, such as technological innovations or customer preferences, can change rapidly. This volatility in value poses challenges in accurately capturing and reporting the changing worth of these assets.

- Impairment Challenges: Assessing impairment of intangible assets can be complex, as there may be limited market data or clear indicators of impairment. Determining when impairment has occurred and calculating the impairment loss accurately can be challenging for companies.

It is important for stakeholders to be aware of these challenges and limitations when analyzing financial statements that include intangible assets. Understanding the potential biases and uncertainties associated with intangible asset reporting can help users of financial information make more informed decisions and assessments.

Efforts are being made to improve the consistency and comparability of intangible asset reporting. Accounting standards bodies are working toward establishing more specific guidelines and methodologies for valuing and reporting intangible assets. Additionally, increased transparency and disclosure requirements can help address some of the challenges and limitations associated with intangible asset reporting.

Conclusion

Intangible assets play a crucial role in the financial landscape of companies across various industries. Although intangibles lack physical presence, they hold substantial value and contribute significantly to a company’s success. Recognition and reporting of intangible assets on the balance sheet are essential for providing a comprehensive and accurate picture of a company’s financial situation. Including intangibles in financial analysis allows stakeholders to gain a deeper understanding of a company’s value, competitive advantage, and potential growth opportunities.

However, there are challenges and limitations associated with intangible asset reporting. These include subjectivity in valuation, lack of standardization, measurement challenges, limited disclosure, rapidly changing value, and impairment considerations. Being aware of these limitations is important for stakeholders to effectively analyze and interpret financial statements that include intangible assets.

Efforts are being made to address these challenges and improve the consistency and comparability of intangible asset reporting. Standardized methodologies and increased transparency in reporting practices can enhance the reliability and usefulness of information related to intangible assets.

In conclusion, recognizing and accurately reporting intangible assets on the balance sheet is critical for stakeholders to assess a company’s value, competitive positioning, and long-term prospects. Despite the challenges, understanding the implications and limitations of intangible asset reporting enables informed decision-making and enhances the overall understanding of a company’s financial health and performance.