Finance

Where Is Inventory On The Balance Sheet

Modified: February 21, 2024

Find out where inventory is reported on the balance sheet in finance. Understanding inventory management and its impact on financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Balance Sheet

- Components of the Balance Sheet

- Definition of Inventory

- Importance of Inventory on the Balance Sheet

- Classifying Inventory on the Balance Sheet

- Presentation of Inventory on the Balance Sheet

- Valuation of Inventory on the Balance Sheet

- Influence of Inventory on Financial Statements

- Conclusion

Introduction

Welcome to the world of finance, where numbers and transactions play a crucial role in the success of businesses and individuals alike. In the realm of financial statements, the balance sheet holds significant importance as it provides a snapshot of a company’s financial health at a specific point in time. Among the various components of the balance sheet, one item that warrants attention is inventory.

Inventory is a vital asset for many businesses, particularly those involved in manufacturing or retail. It represents the goods or products that a company holds for sale or for use in the production process. From raw materials to finished goods, inventory encompasses a wide range of items that contribute to a company’s operations and bottom line.

Understanding where inventory is positioned on the balance sheet is crucial for both financial professionals and business owners. It not only gives insights into the financial well-being of a company but also influences how various stakeholders perceive its performance and potential for growth.

In this article, we will delve into the concept of inventory on the balance sheet, discussing its definition, importance, classification, valuation, and its impact on financial statements. By the end, you will have a comprehensive understanding of how inventory fits into the bigger picture of financial reporting.

Understanding the Balance Sheet

Before delving into the specifics of inventory on the balance sheet, it is essential to have a clear understanding of what the balance sheet represents. The balance sheet is one of the three primary financial statements, along with the income statement and statement of cash flows. It provides a snapshot of a company’s financial position at a specific point in time, typically at the end of an accounting period.

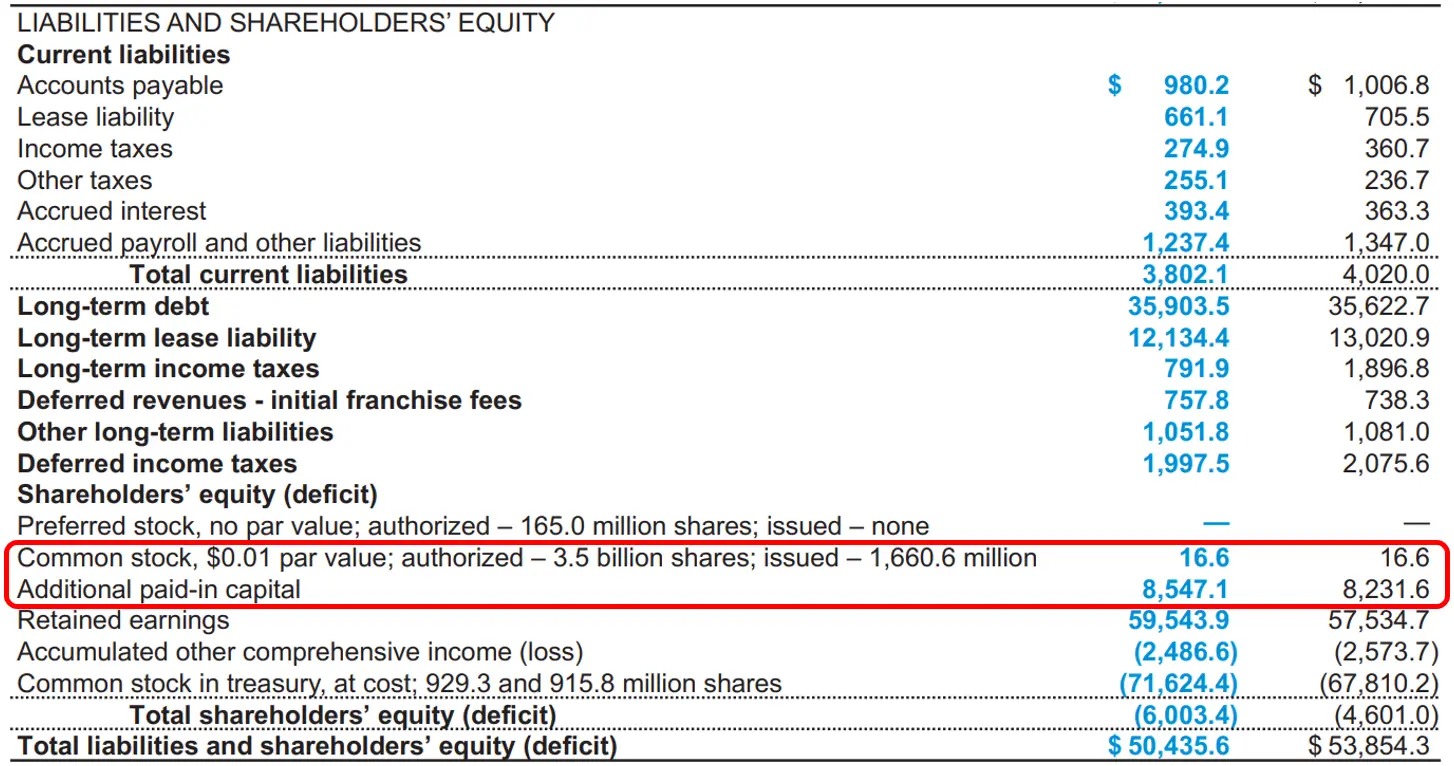

The balance sheet follows a fundamental accounting equation: Assets = Liabilities + Equity. It showcases the company’s assets, liabilities, and shareholders’ equity. Assets represent what the company owns, including cash, inventory, property, and equipment. Liabilities represent the company’s obligations, such as loans, accounts payable, and accrued expenses. Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities.

The balance sheet is often referred to as a “balance” sheet because the total assets must always equal the total liabilities plus equity. This equation ensures that the accounting equation is in balance and provides a clear picture of a company’s financial health.

Now that we have a basic understanding of the balance sheet, let’s explore the role of inventory within this financial statement and why it holds significance for businesses.

Components of the Balance Sheet

The balance sheet consists of several key components that provide a comprehensive view of a company’s financial position. These components help stakeholders analyze the company’s assets, liabilities, and equity, allowing them to evaluate its financial stability and performance.

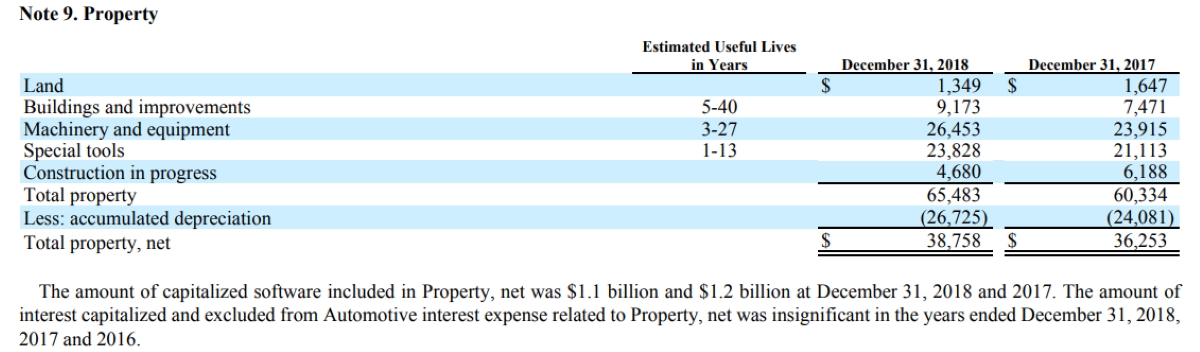

1. Assets: Assets represent what the company owns or controls and can be categorized into current assets and non-current assets. Current assets are those that are expected to be converted into cash or used up within one year, such as cash, accounts receivable, and inventory. Non-current assets, on the other hand, are assets that are expected to provide economic value for more than one year, such as property, plant, and equipment.

2. Liabilities: Liabilities reflect the company’s obligations or debts. Like assets, liabilities can be categorized into current and non-current liabilities. Current liabilities are those that are due within one year, such as accounts payable, short-term loans, and accrued expenses. Non-current liabilities are debts that are due after one year, including long-term loans and bonds.

3. Equity: Equity, also known as shareholders’ equity or net assets, represents the residual interest in the company’s assets after deducting liabilities. It is the value that belongs to the owners or shareholders of the company. Equity can be further divided into contributed capital (capital raised through the issuance of stock) and retained earnings (accumulated profits or losses retained in the company).

These components work together to create a balance and provide a snapshot of a company’s financial condition. The balance sheet enables stakeholders to assess the company’s ability to meet its obligations, its level of financial leverage, and the overall value of the company.

Definition of Inventory

Inventory refers to the goods or products that a company holds for sale to customers or for use in the production process. It represents the tangible assets that a company has on hand at any given time. Inventory can come in various forms, including raw materials, work-in-progress (partially completed goods), and finished goods ready for sale.

The definition of inventory may vary depending on the industry and the specific accounting principles followed. However, the core concept remains the same – inventory represents the stock of goods that a company needs to meet customer demand and sustain its operations.

Inventory is a crucial asset for businesses, particularly those involved in manufacturing, distribution, and retail. Efficient management of inventory ensures that a company can meet customer demand, minimize stockouts, and optimize cash flow. On the other hand, poor inventory management can lead to overstocking, increased carrying costs, and obsolescence of products.

To effectively manage inventory, companies need to carefully monitor and control various inventory-related metrics, such as inventory turnover, carrying costs, and obsolete inventory. By understanding the value and composition of their inventory, businesses can make informed decisions regarding production, procurement, pricing, and sales strategies.

Inventory can be one of the largest assets on a company’s balance sheet. Its accurate valuation and proper classification are crucial for financial reporting and decision-making processes. In the next sections, we will explore the importance of inventory on the balance sheet and how it is classified and presented within the financial statements.

Importance of Inventory on the Balance Sheet

Inventory plays a critical role on the balance sheet as it represents a significant portion of a company’s assets. Properly managing and valuing inventory is crucial for accurate financial reporting and decision-making. Here are key reasons why inventory is important on the balance sheet:

1. Asset Valuation: Inventory represents a valuable asset that a company holds, which contributes to its overall net worth. Properly valuing inventory ensures that the balance sheet accurately reflects the company’s financial position.

2. Profitability Analysis: The balance sheet, specifically the inventory component, allows stakeholders to evaluate a company’s profitability. By examining how inventory levels change over time, one can assess the efficiency of inventory management and the company’s ability to generate profits.

3. Operational Efficiency: Inventory levels on the balance sheet provide insights into a company’s ability to manage its supply chain and meet customer demand. Too much inventory can result in increased carrying costs, while insufficient inventory may lead to stockouts and missed sales opportunities.

4. Working Capital Management: Inventory is a crucial component of a company’s working capital. By monitoring inventory levels, businesses can effectively manage their cash flow and optimize working capital requirements.

5. Financial Performance: The value and composition of inventory on the balance sheet can impact a company’s financial performance indicators, such as gross profit margin, inventory turnover, and return on assets. These metrics provide insights into a company’s efficiency, profitability, and utilization of its assets.

6. Investor Confidence: The presentation and management of inventory on the balance sheet can influence investor confidence and perception of a company. Transparent and accurate reporting of inventory assets instills trust and helps investors make informed investment decisions.

Overall, inventory on the balance sheet reflects the tangible assets that a company possesses to generate revenue. Its proper valuation, monitoring, and management are essential for financial stability, operational efficiency, and long-term business success.

Classifying Inventory on the Balance Sheet

When it comes to classifying inventory on the balance sheet, there are different categories that represent the various stages of inventory in a company’s supply chain. Let’s explore the common classifications:

1. Raw Materials: Raw materials are the basic materials that a company uses to produce its products. These can include items like steel, wood, fabric, or chemicals. Raw materials are the starting point of the production process and are typically valued at their cost of acquisition on the balance sheet.

2. Work-in-Progress (WIP): Work-in-progress inventory represents partially completed goods that are still undergoing the production process. This category includes products that have undergone some level of manufacturing or assembly but are not yet considered finished goods. The value of work-in-progress is based on the cost of direct materials, direct labor, and manufacturing overhead incurred up to the respective stage of completion.

3. Finished Goods: Finished goods are the end products that are ready for sale to customers. These items have completed the production process and are considered inventory until they are sold. Finished goods are typically valued at their cost of production, which includes direct materials, direct labor, and manufacturing overhead.

4. Supplies: Supplies, also known as consumables, are materials or items that are used in day-to-day operations but do not become part of the final product. These can include items like office supplies, tools, cleaning supplies, or protective gear. Supplies are typically expensed when they are consumed rather than being classified as inventory.

It is important for companies to accurately classify their inventory based on the various categories mentioned above to provide transparency and clarity in financial reporting. This classification aids in tracking the progress of inventory through different stages of production and enables the identification of potential bottlenecks or inefficiencies in the supply chain.

Additionally, the classification of inventory plays a crucial role in determining the appropriate valuation method to be used for each category. This valuation method affects the carrying value of inventory on the balance sheet and has implications for profit calculations, tax liabilities, and financial analysis.

Now that we understand how inventory can be classified on the balance sheet, let’s delve into how inventory is presented and valued within the financial statements.

Presentation of Inventory on the Balance Sheet

Inventory is typically presented as a separate line item on the balance sheet, under the current assets section. It is important to note that the precise positioning of inventory may vary depending on the accounting framework followed by the company, but it is generally classified as a current asset due to its short-term nature and conversion into cash within the normal course of business.

The presentation of inventory on the balance sheet provides stakeholders with a clear picture of the company’s available stock of goods. It allows them to assess the company’s capacity to fulfill customer demand and manage its overall supply chain effectively.

The valuation of inventory is crucial for its presentation on the balance sheet. There are different methods used to determine the value of inventory, including:

1. First-in, First-out (FIFO): This method assumes that the first items purchased or produced are the first ones sold. Under FIFO, the cost of the oldest inventory is matched with sales first, while the costs of the most recent purchases or production are matched with ending inventory.

2. Last-in, First-out (LIFO): In contrast to FIFO, the LIFO method assumes that the most recently purchased or produced items are the first ones sold. This means that the cost of the most recent purchases or production is matched with sales, while the costs of the older inventory are allocated to ending inventory.

3. Weighted Average Cost: With this method, the cost of inventory is determined based on the average cost of all units available for sale during a given period. It is calculated by dividing the total cost of inventory available for sale by the total number of units.

Once the method of valuation is determined, the carrying value of inventory is calculated by multiplying the quantity of each item by its respective cost. This value is then presented on the balance sheet under the inventory line item.

It is important to note that the carrying value of inventory on the balance sheet may not reflect the current market value or selling price of the goods. Factors such as market conditions, demand, and economic trends can impact the actual value of inventory.

The presentation of inventory on the balance sheet provides stakeholders with valuable insights into the company’s current stock of goods and its ability to maintain a healthy supply chain. It allows for better decision-making processes regarding production, purchasing, pricing, and sales strategies.

Next, we will explore how the valuation of inventory on the balance sheet can influence the company’s financial statements.

Valuation of Inventory on the Balance Sheet

The valuation of inventory on the balance sheet is a critical aspect of financial reporting. It determines the carrying value of inventory and can have significant implications for a company’s financial statements. The valuation method used for inventory impacts key financial metrics and ratios, such as gross profit, cost of goods sold, and inventory turnover. Let’s explore some common methods of inventory valuation:

1. First-in, First-out (FIFO): Under the FIFO method, the cost of the oldest inventory is matched with sales, while the costs of more recent purchases or production are allocated to ending inventory. This method assumes that the first items purchased or produced are the first ones sold. FIFO tends to reflect the current cost of inventory more accurately, especially during inflationary periods.

2. Last-in, First-out (LIFO): In contrast to FIFO, the LIFO method assumes that the most recently purchased or produced items are the first ones sold. This means that the cost of the most recent purchases or production is matched with sales, while the costs of older inventory are allocated to ending inventory. LIFO can be advantageous for companies during periods of inflation, as it results in a higher cost of goods sold and lower taxable income.

3. Weighted Average Cost: With this method, the cost of inventory is determined based on the average cost of all units available for sale during a given period. It is calculated by dividing the total cost of inventory available for sale by the total number of units. The weighted average cost method simplifies the valuation process and is useful when inventory consists of homogeneous items with similar costs.

Each valuation method has its advantages and implications. The choice of inventory valuation method depends on various factors, including industry norms, accounting regulations, tax considerations, and management preference.

It is important to note that the valuation method used for inventory must be consistently applied to ensure comparability across financial periods. Changes in valuation methods can have a significant impact on financial statements and may require disclosure or restatement of prior periods.

The valuation of inventory on the balance sheet affects the cost of goods sold (COGS), which is a key component of the income statement. A change in the cost of goods sold will, in turn, impact the calculation of gross profit and operating profit. Additionally, the valuation of inventory affects the calculation of the company’s asset turnover and inventory turnover ratios, providing insights into the efficiency of inventory management.

Overall, the valuation of inventory on the balance sheet is a crucial aspect of financial reporting. It determines the carrying value of inventory and impacts key financial metrics and ratios. Choosing the appropriate valuation method is essential for accurate financial reporting and informed decision-making.

Influence of Inventory on Financial Statements

Inventory has a significant impact on a company’s financial statements as it interacts with various components of the income statement, balance sheet, and statement of cash flows. Let’s explore how inventory influences these financial statements:

1. Income Statement: The cost of goods sold (COGS) is a key element on the income statement, representing the direct costs associated with the production or acquisition of goods sold during a specific period. The value of inventory directly affects the COGS calculation. An increase in the value of inventory will result in a higher cost of goods sold, thereby reducing gross profit and net income.

2. Balance Sheet: Inventory is classified as a current asset on the balance sheet. The value of inventory contributes to a company’s working capital and overall asset base. Proper valuation and presentation of inventory ensure that the balance sheet accurately reflects the company’s financial position. Additionally, the value of inventory impacts key financial metrics such as the current ratio and quick ratio, which measure a company’s liquidity and ability to meet short-term obligations.

3. Statement of Cash Flows: Inventory management affects cash flows through the purchase or sale of inventory. An increase in inventory levels implies a higher investment of cash, while a decrease in inventory results in cash inflows. Efficient inventory management ensures that the company can optimize cash flows, minimize holding costs, and maintain a healthy cash position.

Furthermore, inventory write-downs or write-offs directly impact the financial statements. A write-down occurs when the value of inventory is reduced due to obsolescence, damage, or a decline in market value. This write-down is charged against the income statement, reducing the net income and equity. A write-off, on the other hand, occurs when inventory becomes completely obsolete or unusable and is removed from the balance sheet entirely.

The management of inventory also affects key financial ratios and performance indicators. The inventory turnover ratio measures how quickly a company’s inventory is sold and replaced. A higher inventory turnover ratio indicates efficient inventory management and a faster conversion of inventory into sales.

Additionally, the gross profit margin is influenced by the value of inventory. A decline in the value of inventory will reduce the gross profit margin, indicating lower profitability. Conversely, effective inventory management can lead to higher profitability by minimizing holding costs, reducing the risk of obsolescence, and optimizing pricing strategies.

In summary, inventory has a significant influence on a company’s financial statements. It impacts the income statement through the calculation of the cost of goods sold. Inventory is a crucial current asset on the balance sheet, affecting working capital and liquidity ratios. Effective inventory management also impacts cash flows and financial performance indicators. Proper valuation, presentation, and management of inventory are vital for accurate financial reporting and informed decision-making.

Conclusion

Inventory holds immense importance on the balance sheet and within the realm of financial reporting. It represents the tangible assets that a company holds, ranging from raw materials to finished goods. Understanding where inventory is positioned on the balance sheet and how it is classified, valued, and presented is vital for financial professionals, business owners, and stakeholders alike.

Proper management of inventory ensures that businesses can effectively meet customer demand, optimize cash flow, and make informed decisions regarding production, procurement, pricing, and sales strategies. Inventory valuation methods, such as FIFO, LIFO, or weighted average cost, impact key financial metrics, such as cost of goods sold, gross profit, and inventory turnover.

The accurate valuation and presentation of inventory on the balance sheet are crucial for transparent and accurate financial reporting. It allows stakeholders to evaluate a company’s financial health, profitability, operational efficiency, and working capital requirements.

Inventory’s influence is not limited to the balance sheet but extends to the income statement and statement of cash flows. The cost of goods sold is directly affected by the value of inventory, impacting gross profit and net income. Efficient inventory management also has a direct impact on cash flows through the purchase, sale, and optimization of inventory levels.

In conclusion, inventory plays a multifaceted role in financial statements, providing insight into a company’s financial health, operational efficiency, and profitability. Accurate valuation, classification, and presentation of inventory on the balance sheet are crucial for informed decision-making, investor confidence, and overall business success. By managing inventory effectively, businesses can navigate the complexities of supply chain management, optimize resources, and ultimately drive sustainable growth.